Những bài báo thế này giống những cổ động viên, những đội cổ động cho các giải bóng đá của trường, của phường, thị trấn.

Bài báo nêu ra những điểm thú vị đầy màu hồng của một nền kinh tế, mà ở đó, những số liệu kinh tế không phản ánh hết guồng máy kinh tế.

Thực tế có sự sôi động mạnh mẽ của giới trẻ trong phong trào Start up. Từ khi cuốn sách Start-Up Nation được dịch sang tiếng Việt, và được nhiều đàn anh tiến bộ giới thiệu đọc, lớp trẻ Việt Nam như được truyền lửa. Trong thế giới phẳng lỳ của công nghệ thông tin, start up trở thành một nam châm hút mọi ánh nhìn.

Phong trào đó tạo nên sự kỳ vọng ghê gớm về sự thay đổi vận mệnh nước Việt. Tuy vậy, tất cả vẫn còn ở thị tương lai. Phong trào sôi động, truyền thông đưa tin, hội thảo mọi lúc mọi nơi nó chỉ cho thấy đây là ngành đang lên, và được nhiều người quan tâm. Nếu hỏi bong bóng tiếp theo sẽ là gì, có lẽ sẽ là “bong bóng startup”.

Quay lại bài viết, nền kinh tế Việt Nam rõ ràng có sự cải thiện mạnh mẽ trong những năm gần đây, ít ra là qua các con số. GDP chính thức tạo đáy vào quý 1/2012, với tốc độ tăng trưởng GDP chỉ là 4.75%, đến quý 1/2016, con số này lên 6.68%. Kèm với đó, là sự cải thiện của chỉ số sản xuất công nghiệp, doanh số bán lẻ, của niềm tin tiêu dùng. Tuy vậy, số liệu thống kê tổng kia bao gồm sự méo mó trong đó.

Nếu nhìn số liệu xuất nhập khẩu, con số xuất siêu và tăng trưởng xuất khẩu mạnh mẽ những năm qua đến từ nhóm FDI, nếu không tính khối này, nền kinh tế chúng ta nhập siêu triền miên.

Nếu không nhờ nhóm FDI, dự trữ ngoại tệ VN sẽ không cao như hiện tại, và khủng hoảng có lẽ chưa qua, thị trường ngoại hối và tỷ giá đồng VND có lẽ không thể kiểm soát.

Tuy vậy, nếu chỉ nhìn con số tổng thể, chúng ta sẽ không nhìn hết bức tranh. Nói đến bức tranh hiện tại, nó không khác gì câu nói vui trong môn hóa học phổ thông “giàu thì giàu thêm và nghèo có khi vẫn cứ nghèo”.

Sự phân hóa đang diễn ra với nhịp độ nhanh và mạnh chưa từng có.

Finandlife

--------------------

Vietnam's Economy Is an Emerging Market Standout (nổi bật)

Nguyen Dieu Tu Uyen, Bloomberg

Entrepreneur Le Thi Hang is scouting sites to open two more convenience stores in Hanoi, encouraged by rising sales at her one-year old shop.

“I don’t want to miss this chance,” said Hang, 32, who expects revenue to double this year with the expansion. Sales of food items including instant noodles, fish sauce, sugar, bread and milk are rising, she said.

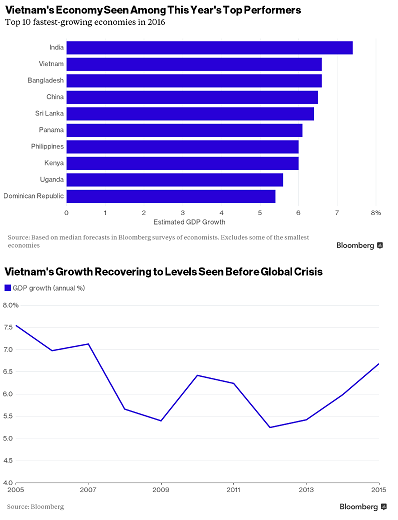

While the world’s largest emerging economies including Russia, Brazil and China falter, Vietnam’s steady economic growth at near 7 percent this year will make it among the fastest-growing markets in the world. Rising domestic demand and booming foreign direct investment are helping the Southeast Asian nation counter global threats that’s sparked a wave of stock selling and currency depreciation this year.

That comes as the country begins a leadership transition this week that will set the tone for economic reform and growth. The Communist party’s draft socioeconomic plan for 2016 to 2020 shows the nation will target as much as 7 percent average annual expansion.

"In a very subdued (yếu, thờ ơ) global environment, domestic demand is king," said Trinh Nguyen, a Hong-Kong based senior economist for emerging Asia at Natixis SA said. “People in Vietnam are becoming more optimistic about the future. In both the regional and global landscapes, it’s set to outperform."

New Leaders

Vietnam’s economy is forecast to expand 6.7 percent this year, the same pace as in 2015, according to Bloomberg surveys.

Communist party officials gathering to choose the next party general secretary will also be tasked with setting a growth path that avoids a repeat of past mistakes, including soaring credit growth that saddled banks with bad debt and preferential treatment of state companies that created inefficiencies.

"Vietnam is positioned to have another stellar (ngôi sao) year in 2016," economists at Australia & New Zealand Banking Group Ltd. led by Eugenia Victorino said in a report this month. "Nonetheless, the long-term outlook will depend on the outcome of the political changes expected over the next 12 months."

The central bank’s recent efforts to make the exchange rate more flexible will also strengthen macro-economic stability and help ease pressure on reserves, she said.

Meanwhile, private consumption rose 9.3 percent last year, according to government data. Disbursed (giải ngân) foreign direct investment surged 17.4 percent to a record-high of $14.5 billion last year from 2014, official data showed.

Vietnam’s stock market has also attracted foreign investors, with overseas investors net buyers for the 10th consecutive year in 2015. The benchmark VN Index gained for the first day in five, adding 1.8 percent at the close of trading Tuesday.

New Five-Year Plan

The draft plan shows the government aiming to lift gross domestic product per capita to $3,200 to $3,500 by 2020 compared with the International Monetary Fund’s estimate of about $2,171 in 2015. Inflation will be kept below 5 percent and the budget deficit capped at 4 percent of GDP.

Vietnam growth recovering

“In 2016 and 2017, we definitely believe that Vietnam is positioned to be one of the fastest growth stories,” said Victorino. “What could derail (trật đường ray) Vietnam’s fast growth story is if trade deficit widens due to much faster import growth from consumption-related items such as automobiles.”