Summary all public writings Warren Buffett

- High returns on equity should retain much or all its earnings so that shareholders can earn premium returns on enhanced capital > ROE > Cost of capital to create value

- “Forecasts are dangerous particularly those about the future.” – Sam Goldwyn

- In the 1981 shareholder letter, Warren Buffett mentioned for the first time: “Charlie and I work as partners in managing all controlled companies.”

- Operating earnings/equity capital = most important yardstick of single-year managerial performance

- Accounting earnings can seriously misrepresent economic reality

- It is our job to select businesses with economic characteristics that allow each dollar of retained earnings to be translated eventually into at least a dollar of market value

- A too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments

- Businesses in industries with both substantial over-capacity and a ‘commodity’ product are prime candidates for profit troubles

- Our share issuances follow a simple basic rule: we will not issue shares unless we receive as much intrinsic business value as we give

- Managers who want to expand their domain at the expense of owners might better consider a career in government

- What Buffett prefers to acquire:

1. Large purchases (at least $5 million of after-tax-earnings)

2. Demonstrated consistent earnings power (future projections are of little interest to us, nor are “turn-around” situations

3. Businesses earning good returns on equity while employing little or no debt

4. Management in place (we can’t supply it)

5. Simple businesses (if there’s lots of technology we won’t understand it)

6. An offering price (We will never engage in unfriendly transactions.)

- “We’ve always found a telephone call to be more productive than a half-day committee meeting.”

- “If we can continue to attract managers with the qualities of Ben and Phil, you don’t need to worry about Berkshire’s future”

- The major business principles Buffett uses to maintain the manager-owner relationship:

o Although our form is corporate, our attitude is partnership

o At least four of the five, over 50% of the family net worth is represented by holdings of Berkshire. We eat our own cooking

o Our long-term economic goal is to maximize the average annual rate of gain in intrinsic business value on a per-share basis

o Our preference would be to reach this goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital

o Consolidated reported earnings may reveal relatively little about our true economic performance. à báo cáo hợp nhất ?

o Accounting consequences do not influence our operating capital-allocation decisions

o We rarely use much debt, and when we do, we attempt to structure it on a long-term fixed-rate basis

o A managerial “wish list” will not be filled at shareholder expense

o We feel noble intentions should be checked periodically against results. à mọi thứ phải được thể hiện bằng kết quả định kỳ

o We will use common stock only when we receive as much in business value as we give

o We have no interest at all in selling any good businesses that Berkshire owns and are very reluctant to sell sub-par businesses as long as we expect them to generate at least some cash and as long as we feel good about their managers and labor relations.

o We will be candid in our reporting to you, emphasizing the pluses and minuses important in appraising business value

o Good investment ideas are rare, valuable, and subject to competitive appropriation just as good product or business acquisition ideas are

- Book value tells you what has been put in, intrinsic business value estimates what can be taken out

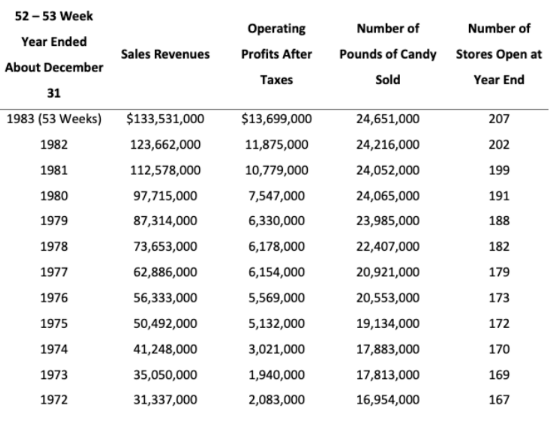

- The record of Chuck Huggins at See’s Candies

- About Geico: its superiority reflects the combination of a truly exceptional business idea and an exceptional management

- We try to attract investors who will understand our operations, attitudes and expectations

- Businesses needing little in the way of tangible assets simply hurt the least in times of inflation

- Asset-heavy businesses generally earn low rates of return – rates that often barely provide enough capital to fund the inflationary needs of the existing business, with nothing left over for real growth, distribution to owners, or for acquisition of new businesses.

- When companies with outstanding businesses and comfortable financial positions find their shares selling far below intrinsic value in the marketplace, no alternative action can benefit shareholders as surely as repurchases

- The companies in which we have our largest investments have all engaged in significant stock repurchases at times when wide discrepancies existed between price and value à MWG in 2024?

- A manager who consistently turns his back on repurchases when these clearly are in the interests of owners, reveals more than he knows of his motivations

- We feel very comfortable owning interests in businesses such as these that offer excellent economics combined with shareholder-conscious management.

- The business achieves this success because it deserves this success - The success of See’s reflects the combination of an exceptional product and an expectation manager, Chuck Huggins.

- You as shareholders of Berkshire have benefited in enormous measure from the talents of GEICO’s Jack Byrne, Bill Snyder, and Lou Simpson

- We buy marketable stocks for our insurance companies based upon the criteria we would apply in the purchase of an entire business

- Most businesses are unable to significantly improve their average returns on equity – even under inflationary conditions

- We behave with Berkshire’s money as we would with our own

- All earnings are not created equal

- You should wish your earnings to be reinvested if they can be expected to earn high returns, and you should wish them paid to you if low returns are the likely outcome of reinvestment

- Outstanding businesses generate large amounts of excess cash

- We don’t have to worry about quarterly or annual figures but, instead, can focus on whatever actions will maximize long-term value

- My preference is for a market price that consistently approximates business value

- Ben Graham told a story 40 years ago that illustrates why investment professionals behave as they do:

o An oil prospector, moving to his heavenly reward, was met by St. Peter with bad news. “You’re qualified for residence”, said St. Peter, “but, as you can see, the compound reserved for oil men is packed. There’s no way to squeeze you in.” After thinking a moment, the prospector asked if he might say just four words to the present occupants. That seemed harmless to St. Peter, so the prospector cupped his hands and yelled, “Oil discovered in hell.” Immediately the gate to the compound opened and all of the oil men marched out to head for the nether regions. Impressed, St. Peter invited the prospector to move in and make himself comfortable. The prospector paused. “No,” he said, “I think I’ll go along with the rest of the boys. There might be some truth to that rumor after all.” Một người thăm dò dầu mỏ đang trên đường đi tìm phần thưởng trên trời thì gặp Thánh Peter với tin dữ. “Bạn đủ điều kiện để cư trú,” Thánh Peter nói, “nhưng, như bạn thấy, khu nhà dành riêng cho những người làm dầu mỏ đã chật cứng. Không có cách nào để ép bạn vào. Sau khi suy nghĩ một lúc, người thăm dò hỏi liệu ông có thể nói bốn từ với những người đang cư ngụ hiện tại không. Điều đó dường như vô hại đối với Thánh Peter, nên người thăm dò khum tay lại và hét lên: “Dầu được phát hiện ở địa ngục”. Ngay lập tức cánh cổng vào khu nhà mở ra và tất cả những người thợ dầu đều hành quân ra ngoài để tiến về vùng nether. Quá ấn tượng, Thánh Peter đã mời người thăm dò chuyển đến ở và tạo cảm giác thoải mái cho bản thân. Người thăm dò dừng lại. “Không,” anh ấy nói, “tôi nghĩ tôi sẽ đi cùng với những chàng trai còn lại. Có lẽ tin đồn đó có phần nào đó là sự thật.”

- Capital gains or losses in any given year are meaningless as a measure of how well we have done in the current year

- Charlie Munger has always emphasized the study of mistakes rather than successes

- Charlie likes to study errors and I have generated ample material for him, particularly in our textile and insurance businesses

- July 1984: close of textile operation Berkshire Hathaway

o It was a bad business at a cheap valuation level

o A textile company that allocates capital brilliantly within its industry is remarkable, but not a remarkable business

o When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact

- Warren Buffett focuses on the importance of management repeatedly

- Ben Graham said that the key to successful investing is to purchase shares of good businesses when market prices are at a large discount from underlying business values

- No matter how great the talent or effort is, some things just take time. You can’t produce a baby in one month by getting nine women pregnant

- Book value has served for more than a decade as a reasonable if somewhat conservative proxy for business value

- Charlie Munger and I only have two jobs:

o Attract and keep outstanding managers

§ They work because they love what they do and relish the thrill of outstanding performance. They unfailingly think like owners

o Capital allocation

- We intend to continue our practice of working only with people whom we like and admire.

- Our returns are certain to drop substantially because of our enlarged size

- Chuck rightfully measures his success by the satisfaction of our customers

- The business described in this section can be characterized as having very strong market positions, very high returns on capital employed, and the best operating management à Buffett = quality investor!

- Fechheimer is exactly the sort of business we like to buy. Its economic record is superb; its managers are talented, high-grade, and love what they do; and the Heldman family wanted to continue its financial interest in partnership with us.

- In effect, the good news in earnings follows the good news in principles by 6-12 months

- We have no idea – and never have had – whether the market is going to go up, down, or sideways in the near- or intermediate-term future

- We simply attempt to be fearful when others are greedy and greedy when others are fearful

- Stocks can’t outperform businesses indefinitely

- We consider the owner earnings figure to be the relevant item for valuation purposes à reported earnings + depreciation, depletion, amortization, and certain other non-cash changes

- Managers and owners need to remember that accounting is but an aid to business thinking, never a substitute for it

- We own remarkable businesses, and they are run by even more remarkable managers

- Experience, however, indicates that the best business returns are usually achieved by companies that are doing something quite similar today to what they were doing five or ten years ago.

- A business that constantly encounters major change also encounters many chances for major error

- Only 25 of the 1,000 companies met two tests of economic excellence - an average return on equity of over 20% in the ten years, 1977 through 1986, and no year worse than 15%. These business superstars were also stock market superstars:

During the decade, 24 of the 25 outperformed the S&P 500.

o Most use very little leverage compared to their interest-paying capacity

o Most sell non-sexy products or services in much the same manner as they did 10 years ago

- Our managers have produced extraordinary results by doing rather ordinary things – but doing them exceptionally well

- Our goal is to do what always makes sense for Berkshire’s customers and employees

- In a commodity-like business, only a very low-cost operator or someone operating in a protected, and usually small niche can sustain high profitability levels

- What we learn from history is that we do not learn from history

- Whenever Charlie and I buy common stocks for Berkshire's insurance companies (leaving aside arbitrage purchases, discussed later) we approach the transaction as if we were buying into a private business.

- When investing, we view ourselves as a business analysts - not as market analysts, not as macroeconomic analysts, and not even as security analysts.

- Story about Mr. Market:

- We would rather achieve a return of X while associating with people whom we strongly like and admire than realize 110% of X by exchanging these relationships for uninteresting or unpleasant ones

- We try to buy not only good businesses but ones run by high-grade talented and likeable managers

- Good business or investment decisions will eventually produce quite satisfactory economic results, with no aid from leverage

- The major problem we face is a growing capital base

- We look for outstanding businesses run by people we like, admire, and trust

- Focus on good returns on invested capital

- About old managers: “Superb managers are too scarce a resource to be discarded simply because a cake gets crowded with candles”

- Because of the commodity characteristics of the industry, most insurers earn mediocre returns

- Charlie and I appreciate enormously the talent and integrity these managers bring to their businesses

- They love their business, they think like owners, and they exclude integrity and ability

- When we own outstanding businesses with outstanding management, our favorite holding period is forever

- We will continue to concentrate our investments in a very few companies that we try to understand well

- We agree with Mae West: “Too much of a good thing can be wonderful”

- About EMH: it’s an enormous advantage to have opponents who have been taught that it’s useless to even try

- Our goal is to attract long-term owners who, at the time of purchase, have no timetable or price target for sale but plan instead to stay with us indefinitely

- We will keep most of our major holdings, regardless of how they are priced relative to intrinsic business value

- From Berkshire’s present base of $4.9 billion in net worth, we will find it much more difficult to average 15% annual growth in book value than we did to average 23.8% from the $22 million we began with

- Imagine that Berkshire had only $1, which we put in a security that doubled by yearend and was then sold. Imagine further that we used the after-tax proceeds to repeat this process in each of the next 19 years, scoring a double each time. At the end of the 20 years, the 34% capital gains tax that we would have paid on the profits from each sale would have delivered about $13,000 to the government and we would be left with about $25,250. Not bad. If, however, we made a single fantastic investment that itself doubled 20 times during the 20 years, our dollar would grow to $1,048,576. Were we then to cash out, we would pay a 34% tax of roughly $356,500 and be left with about $692,000.

- Most of these managers have no need to work for a living: they show up at the ballpark because they like to hit home runs

- It is great fun to be in business with people you have long admired

- What is best for their owners is not necessarily best for managers

- We are willing to look foolish if we don’t feel we have acted foolishly.

- We continue to be blessed with extraordinary managers at our portfolio companies

- We only want to link up with people whom we like, admire, and trust

- In effect they are trusting us to be intelligent owners, thinking about tomorrow instead of today, just as we are trusting them to be intelligent managers, thinking about tomorrow as well as today

- But as happens in Wall Street all too often, what the wise do in the beginning, fools do in the end

- Whenever an investment banker starts talking about EBITDA, zip up your wallet

- My first mistake, of course, was in buying control of Berkshire. I was enticed to buy it because the price looked cheap. I call this the “cigar butt” approach to investing. Unless you’re a liquidator, that kind of approach to buying businesses is foolish. Never is there just one cockroach in the kitchen. Time is the friend of the wonderful business, the enemy of the mediocre. You might think this principle is obvious, but I had to learn it the hard way. It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price

- Good jockeys will do well on good horses, but not on broken-down nags. I’ve said many times that when a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact. I just wish I hadn’t been so energetic in creating examples

- Charlie and I have not learned how to solve difficult business problems. When we have learned to avoid them. It is because we concentrated on identifying one-foot hurdles that we could step over rather than because we acquired any ability to clear seven-footers à tránh những rắc rối thay vì vào rồi giải quyết rắc rối

- I thought then that decent, intelligent, and experienced managers would automatically make rational business decisions. But I learned over time that isn’t so.

- I made some expensive mistakes because I ignored the power of imperative (sức mạnh của mệnh lệnh)

- After some other mistakes, I learned to go into business only with people whom I like, trust, and admire. As I noted before, this policy in itself will not ensure success. However, an owner – or investor- can accomplish wonders if he manages to associate himself with such people in business who possess decent economic characteristics. We’ve never succeeded in making a good deal with a bad person

- Some of my worst mistakes were not publicly visible. These were stock and business purchases whose virtues I understood and yet didn’t make

- Our consistently conservative financial policies may appear to have been a mistake, but in my view were not.

o We wouldn't have liked those 99:1 odds - and never will. A small chance of distress or disgrace cannot, in our view, be offset by a large chance of extra returns. If your actions are sensible, you are certain to get good results; in most such cases, leverage just moves things along faster. harlie and I have never been in a big hurry: We enjoy the process far more than the proceeds - though we have learned to live with those also.

- Berkshire’s 26-year record is meaningless in forecasting future results

- Charlie and I would hope that Berkshire sells consistently at about intrinsic value

- We own exceptional businesses that are worth considerably more than the values at which they are carried on our books

- Our extraordinary returns flow from outstanding operating managers, not fortuitous industry economics

- Charlie and I always have preferred a lumpy 15% return over a smooth 12%

- We have no interest in purchasing poorly-managed companies at a cheap price. Instead, our only interest is in buying into well-managed companies at a fair price

- Investors who expect to be ongoing buyers of investments throughout their lifetimes should adopt a similar attitude toward market fluctuations; instead many illogically become euphoric when stock prices rise and unhappy when they fall. They show no such confusion in their eaction to food prices: Knowing they are forever going to be buyers of food, they welcome falling prices and deplore price increases. (It's the seller of food who doesn't like declining prices.)

- We will be buying businesses - or small parts of businesses, called stocks - year in, year out as long as I live (and longer, if Berkshire's directors attend the seances I have scheduled). Given these intentions, declining prices for businesses benefit us, and rising prices hurt us.

- It’s optimism that is the enemy of the rational buyer

- In a business selling a commodity-type product, it’s impossible to be a lot smarter than your dumbest competitor