Early Partnership (1956-1969)

- I do not attempt (nỗ lực)to forecast either business or the stock market

- I do not attempt to forecast the general market. My efforts are devoted (tận tâm)to finding undervalued securites

- I will continue to forecast that our results will be above average in a declining or level market, but it will be all we can do to keep pace with a rising market

- Our performance in a single year has serious limitations as a basis for estimating long-term results

- The higher the level of the market, the fewer the undervalued securities

- I would rather sustain (thà chịu) the penalties (hình phạt)resulting from over-conservatism than face the consequences of error

- I own thirty to forty securities of high quality. This policy should lead to superior results in bear markets and average performance in bull markets

- My continual objective in managing partnership funds is to achieve a long-term performance record superior to that of the Industrial Average. I believe this Average, over the years, will parallel the results of leading investment companies. Unless we do achieve this superior performance there is no reason for The existence of the partnerships.

- Our bread-and-butter business is buying undervalued securities and selling when the under valuation is corrected along with investment in special situations when the profit is dependent on corporate rather than market action à My thinking, If you sell when your business is fair or over value 20%. Why buyers accept that price?

- One year is far too short a period to form any kind of an opinion as to investment performance

- My thinking is much more geared (hướng hơn)to a five-year performance

- Such a commitment may be a deterrent (ngăn cản)to short-range performance, but it gives strong promise of superior results over a several-year period combined with substantial defensive characteristics

- My wife and I will have the largest single investment in the new partnership

- In strongly advancing markets I expect to have real difficulty keeping up with the general market

- It is my feeling that three years is a very minimal test of performance

- Just because something is cheap does not mean it is not going to go down

- We invest in 3 categories:

o Undervalued securities

o Work-outs: these are securities whose financial results depend on corporate action

o Control situations: where we either control the company or take a very large position and attempt to influence the policies of the company

- You will not be right simply because many people momentarily (trong giấy phút)agree with you

- You will be right, throughout many transaction, if your hypotheses (giả thuyết)are correct, your facts are correct, and your reasoning is correct. True conservatism is only possible through knowledge and reason.

- I feel the most objective test as to just how conservative our manner of investing is arises through evaluation of performance in down markets. Khi thị trường xuống, hiệu suất đầu tư như thế nào là cách đánh giá khách quan nhất.

- Complete honesty of Warren Buffett: ‘It may turn out that I am completely wrong.”

- Investment performance must be judged over a period of time with a period including both advancing and declining market

- The ground rules of Berkshire Hathaway:

o In no sense is any rate of return guaranteed to partners

o Whether we do a good job, or a poor job is not to be measured by whether we are plus or minus for the year

o While I much prefer a five-year test, I feel three years is an absolute minimum for judging performance

o I am not in the business of predicting general stock market or business fluctuations

o I cannot promise results to partners. What I can and do promise is that:

§ Our investment will be chosen based on value, not popularity

§ We will attempt to bring the risk of permanent capital loss to an absolute minimum

§ My wife, children and I will have virtually our entire worth invested in the partnership

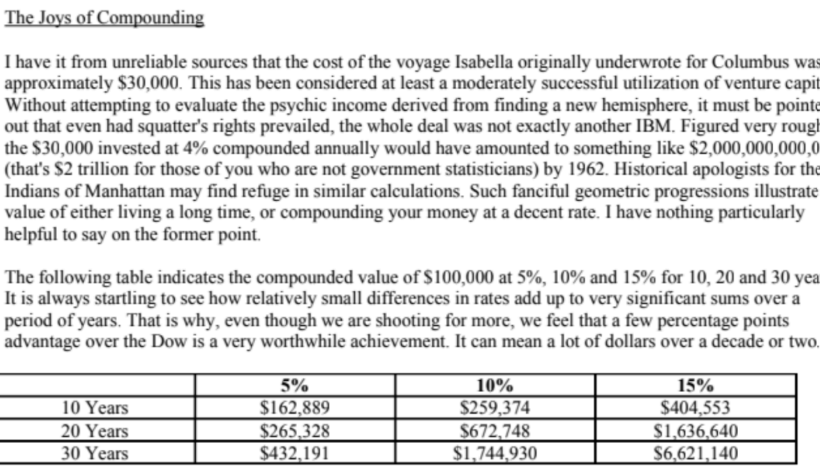

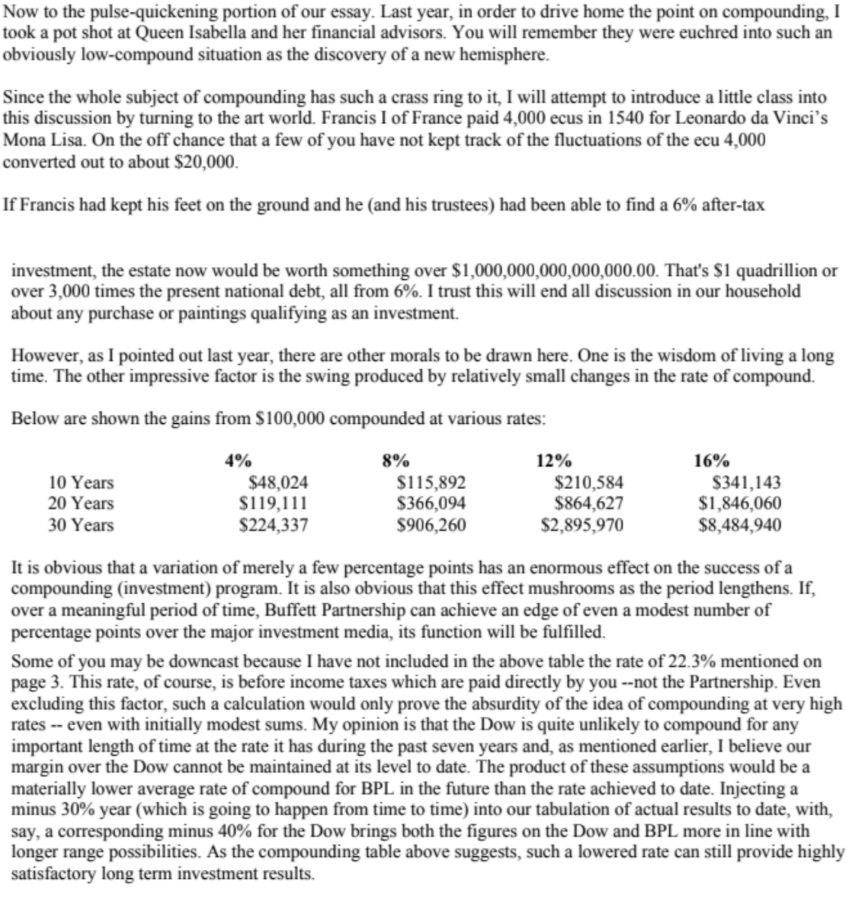

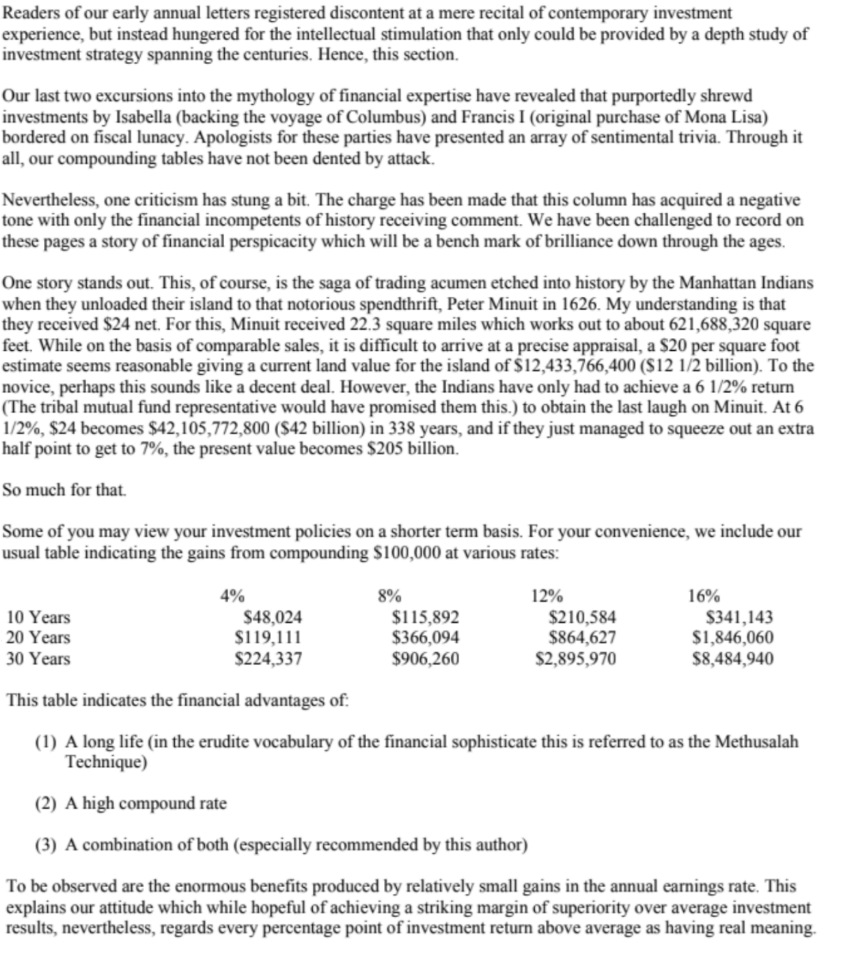

- The Joys of Compounding:

- Just because something is cheap does not mean it is not going to go down

- “Never count on making a good sale. Have the purchase price be so attractive that even a mediocre (tầm thường)sale gives good results. The better sales will be the frosting (phủ sương)on the cake.”

- I feel the most objective test as to just how conservative our manner of investing is arising through evaluation of performance in down markets

- I am certainly not going to predict what general business, or the stock market is going to do in the next year or two since I don’t have the faintest idea (ý tưởng mờ nhạt)

- We think that short-term results (less than three years) have little meaning

- Investment decisions should be made based on the most probable compounding of after-tax net worth with minimum risk

- The Joys of Compounding:

- Our business is one requiring patience

- About the importance of patience: “It would not surprise me if we continue to do nothing but patiently buy these securities week after week for at least another year, and perhaps even two years or more

- In the great majority of cases, the lack of performance exceeding or even matching an unmanaged index in no way reflects a lack of either intellectual capacity or integrity. I think it is much more the product of: (1) group decisions - my perhaps jaundiced view is that it is close to impossible for outstanding investment management to come from a group of any size with all parties really participating in decisions; à Hiệu suất đầu tư kém như một quỹ không được quản lý không hẳn đến từ sự thiếu thông minh mà đến nhiều hơn từ thiết kế sản phẩm, thứ nhất là quyết định của một nhóm, việc đầu tư hiệu quả không thể đến từ một nhóm cùng quyết định, ngay cả khi các thành viên của nhóm đó đều tham gia vào (2) a desire to conform to the policies and (to an extent) the portfolio of other large well-regarded organizations; (3) an institutional framework whereby average is "safe" and the personal rewards for independent action are in no way commensurate with the general risk attached to such action; (4) an adherence to certain diversification practices which are irrational; and finally and importantly, (5) inertia.

- The Joys of Compounding:

- “If you can’t stand the heat, stay out of the kitchen.” – Harry Truman

- Expectations Warren Buffett in 1965:

- Susie and I presently have an interest of $3,406,700 in BPL which represents virtually our entire net worth. So, we all continue to eat home cooking.

- I am extremely fortunate (may mắn kinh khủng)in being able to spend the great majority of my time thinking about capital allocation

- Our long-term goal is to achieve a ten-percentage point per annum advantage over the Dow Jones à Outperform 10% vs VNIndex?

- When a controlling interest is held, we own a business rather than a stock, and a business valuation is appropriate à Khi nắm quyền kiểm soát, thì nắm doanh nghiệp chứ không còn là cổ phiếu, và định giá doanh nghiệp là phù hợp, việc này rất quan trọng, vì nếu không kiểm soát, BLD leak lợi nhuận, và ăn trên đầu trên cổ cổ đông, giá cổ phiếu undervalue, nhưng cổ đông không có cơ hội hiện thực hóa lợi nhuận như giá hợp lý

- We are going to have loss years and are going to have years inferior to the Dow – no doubt about it

- I ensure that I will not get blamed for the wrong reason (having losing years) but only for the right reason (doing poorer than the Dow)

- If you do not feel our standard (a minimum of a three-year test versus the Dow) is an applicable one, you should not be in the Partnership

- We diversify substantially less than most investment operation. We might invest up to 40% of our net worth in a single security under condition coupling an extremely high probability that our facts and reasoning are correct with a very low probability that anything could drastically change the underlying value of the investment."

- We must work extremely hard to find just a very few attractive investment opportunities

- Our summation on overdiversification: “You’ve got a harem (hậu cung) of seventy girls; you don’t get to know any of them very well.” – Billy Rose

- Our present setup unquestionably lets me devote a higher percentage of my time to thinking about the investment process than virtually anyone else in the money management business

- “I am not in the business of predicting general stock market or business fluctuations. If you think I can do this, or think it is essential to an investment program, you should not be in the partnership.”

- We don't buy and sell stocks based upon what other people think the stock market is going to do (I never have an opinion) but rather upon what we think the company is going to do. The course of the stock market will determine, to a great degree, when we will be right, but the accuracy of our analysis of the company will largely determine whether we will be right. In other words, we tend to concentrate on what should happen, not when it should happen.

- The various businesses that the company operated were understandable and we could check out competitive strengths and weaknesses thoroughly with competitors, distributors, customers, suppliers, ex-employees, etc.

- New ideas are continually measured against present ideas

- I am willing to trade the paints of substantial short-term variance in exchange for maximization of long-term performance

- “Buy the right company and the price will take care of itself.”

- I do not attempt to guess the action of the stock market and haven’t the foggiest notion (khái niệm mơ hồ nhất)as to whether the Dow will be at 600,900 or 1200 a year from now

- My mentor Ben Graham used to say “Speculation is neither illegal, immoral nor fattening (béo bở)(financially).”

- I make no effort to predict the course of general business or the stock market. Period.

- Price is what you pay, value is what you get

- Admitting mistakes: “Our poor experience this year is 100% my fault”.

- I want all partners to obtain (nhận được)exactly the same information

- About Berkshire Hathaway: “Its return on capital has not been sufficient to support the assets employed in the business.”

- The three excellent businesses are all run by men over sixty who are largely responsible for building each operation from scratch (từ đầu)

- Over the long term, intrinsic value is virtually (hầu như) always reflected at some point in the market price

- I think about them as businesses not ‘stocks’ and if the business does all right over the long term, so will the stock

- I make no forecasts regarding the bond market (or stock market)

- My approach to bonds is pretty much the same as my approach to stocks. If I can’t understand something, I tend to forget it

- On the importance of capital allocation: It will continue to be the objective of management to improve the return on total capitalization (long-term debt + equity) as well as the return on equity capital)

- Vic is cut from the same cloth as Jack Ringwalt and Gene Abegg, with a talent for operating profitably accompanied by enthusiasm for his business. These three men have built their companies from scratch and, after selling their ownership for cash, retain every bit of the proprietary interest and pride that they have always had

- In 1972, Buffett focused on Operating Earnings/Shareholders Equity and Book Value per share growth

- Management’s objective is to achieve a return on capital over the long term which averages somewhat higher than that of American industry generally

- Our equity investments are heavily concentrated in a few companies that are selected based on favorable economic characteristics, competent and honest management, and a purchase price attractive when measured against the yardstick of value to a private owner. When such criteria are maintained, we intend to hold for a long time.

o With this approach, stock market fluctuations are of little importance to us – except as they may provide buying opportunities – but business performance is of major importance

- We consider the return on shareholders’ equity to be a very important yardstick (thước đo)of economic performance

- It is comforting to be in a business where some mistakes can be made and yet a quite satisfactory overall performance can be achieved. In a sense, this is the opposite case from our textile business where even very good management probably can average only modest results. (- Thật thoải mái khi làm việc trong một doanh nghiệp có thể mắc phải một số sai sót nhưng vẫn đạt được hiệu quả hoạt động tổng thể khá khả quan. Theo một nghĩa nào đó, đây là trường hợp ngược lại với hoạt động kinh doanh dệt may của chúng tôi, nơi mà ngay cả sự quản lý rất tốt cũng có thể chỉ đạt được kết quả trung bình ở mức khiêm tốn.)

- We are very fortunate (thật may mắn)to have the group of managers that are associated with us

- Most of our large stock positions are going to be held for many years and the scorecard on our investment decisions will be provided by business results over that period, and not by prices on any given day

- We select our market equity securities following 4 criteria:

o We should understand the business

o With favorable long-term prospects

o Operated by honest and competent people

o Available at a very attractive price

- We do not attempt to predict how security markets will behave. Successfully forecasting short-term stock price movements is something we think neither we nor anyone else can do.

- About Berkshire Hathaway: we hope we don’t get into too many more businesses with such tough economic characteristics

- It is easier to buy a good business than to create one

- We are not concerned with whether the market quickly revalues upward securities that we believe are selling at bargain prices. We prefer just the opposite since, in most years, we expect to have funds available to be a net buyer of securities à Buy the company mới nghĩ thế được, buy the stock thì không dễ tí nào

- We continue to feel that the ratio of operating earnings (before securities gains or losses) to shareholders’ equity with all securities valued at cost is the most appropriate way to measure any single year’s operating performance

- The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed and not the achievement of consistent gains in earnings per share

- Turnarounds seldom turn

- We would rather have some slack in the organization from time to time than keep everyone busy writing business on which we are going to lose money àJ

- Our owners and managers both have very long-time horizons regarding this business and it is difficult to say anything new or meaningful each quarter about events of long-term significance

- If they focus their thinking and communications on short-term results or short-term market consequences they will, in large part, attract shareholders who focus on the same factors

- We continue to achieve a long-term return on equity that considerably exceeds the average of our yearly returns

- It is encouraging to realize that our record was achieved despite many mistakes

- The combination of a very important and very hard-to-duplicate business advantage with extraordinary management whose skills in operations are matched by skills in capital allocation is phenomenal

- Forecasts may tell you a great deal about the forecasters, they tell you nothing about the future. àJ

- Selling the better assets and keeping your biggest losers is probably less painful in the short term, but is very unlikely to be a winner in the long term

- The most attractive opportunities may present themselves at a time when credit is extremely expensive. At such time we want to have plenty of financial firepower.

- Though this fiduciary attitude was always dominant (mặc dù thái độ ủy thác luôn chiếm ưu thế), his superb managerial skills enabled the Bank to regularly achieve the top position nationally in profitability

- While market values track business values quite well over long periods, in any given year the relationship can gyrate capriciously (thay đổi thất thường)

- Two characteristics of companies that are well-adapted to an inflationary environment:

o The Ability to increase prices rather easily

o The ability to accommodate large dollar volume increases