“Nature does not hurry, yet everything is accomplished.” Lao Tzu

Michael Kokalari, CFA

Chief Economist, Vinacapital

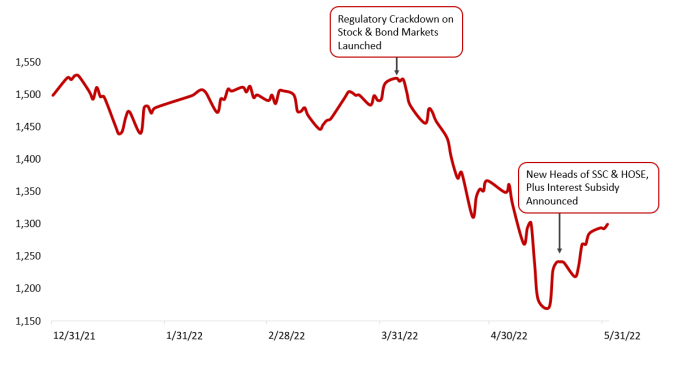

Vietnam’s benchmark VN-Index (VNI) has rebounded by 12% since hitting a bottom on May 16th, driven by a modest thawing of recent bearish sentiment in global stock markets over the last few weeks, and by positive developments in Vietnam. Specifically, the expectation that the Fed may pause its rate hikes boosted global stock markets, while the easing of COVID restrictions in China improved sentiment towards Vietnam’s stock market, and some of the Vietnam-specific concerns that weighed heavily on the VNI in May – which are discussed below - have eased.

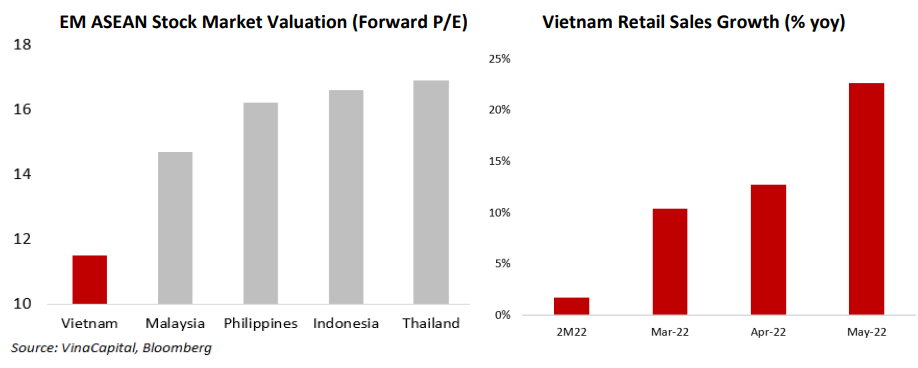

In addition, as can be seen in the chart above, Vietnam’s economic recovery continued to accelerate in May. Meanwhile, Vietnam’s stock market is still cheap at an 11.5x forward P/E versus our expectation for EPS earnings growth of over 20% in 2022, and versus an average 16.2x forward P/E ratio for Vietnam’s EM ASEAN peers. All of this sets the stage for further gains in the VNI as 2022 progresses and we see signs that both foreign and Vietnamese investors agree.

Even as the market sold off, foreign investors bought over USD150 million in stocks in May (including about USD125 million of foreign inflows into ETFs) after having sold around USD290 million worth of stocks in Q1. In addition, Vietnam’s stock market trading volume plunged by over 33% month-on-month in May, implying that Vietnamese retail investors were not panicked into selling the stocks they held as the market declined during the month. We believe the confidence exhibited by both local and foreign investors stems in part from the 33% yoy surge in Vietnam’s earnings growth in Q1, which in-turn should also help drive further gains for the VN-Index later this year, although the next 2-3 months are likely to be fairly volatile.

This volatility, coupled with performance dispersion among the stocks and sectors1 in the market, will likely present active managers like VinaCapital ample opportunities to out-perform the benchmark VN-Index. For example, as of yesterday VinaCapital’s UCITS fund, VVF, outperformed the VNI by over 15%pts YTD (the fund’s NAV increased by 1% versus a 14.1% drop in the VNI, in USD terms), and that outperformance is partly attributable to 38% expected earnings growth for the stocks held by the fund.

Positive Developments in Vietnam Boosted the Market

We believe four developments are currently supporting local investor sentiment:

1) The perception that the recent wave of margin-prompted selling is over

2) The announcement of a 2% interest rate subsidy by the Government to support SMEs and other businesses

3) Continued positive developments in the economy – including a record yoy surge of retail sales in May

4) The growing perception that current global events will benefit Vietnam’s economy.

Further to that last point, several of Vietnam’s key leaders, including Prime Minister Chinh, have made highly visible statements in recent weeks about how recent world developments will benefit Vietnam’s FDI inflows2, and help other areas of the economy, as well as the Government’s continued commitment to infrastructure development. Further to #1 above, we estimate that the total amount of stock market margin outstanding has dropped by more than 30% from its peak earlier this year. Further to #2 above, on May 20th, the Government formally deployed a previously announced scheme to subsidize loans to SMEs and other targeted businesses (including those in the tourism sector) by 2%pts. This interest rate subsidy program is a component of the Government’s 4%/GDP fiscal stimulus package which we discussed in this report, and the announcement of this subsidy significantly boosted investor sentiment.

Next, Vietnam’s economic statistics for May confirmed what we have discussed in our reports all year. The post-COVID economic recovery is going to be much stronger than most analysts had previously expected, driven by a resurgence of domestic consumption and foreign tourist arrivals. We are still forecasting 6.5% GDP growth this year, but we see increasing upside to that forecast, and are aware of some forecasts that are as high as 9% for GDP growth this year.

In short, the jump in Vietnam’s retail sales has dramatically accelerated as 2022 has progressed (as can be seen in the table on page 1) and Vietnam’s manufacturing sector output grew by 9% yoy in 5M22, which is a much stronger performance than we expected. Vietnam’s PMI index rose from 51.7 in April, to 54.7 in May – the biggest one-month acceleration in over a year – driven by an acceleration in new orders.

Regulatory Issues Weighed on the Market in May

In addition to all the Vietnam-specific factors discussed above, the Government’s renewed efforts to strengthen regulatory oversight of Vietnam’s stock and bond markets initially fuelled the sell-off in the stock market in April and in the first half of May. However, on May 20th, several leadership changes were announced at the State Securities Commission (SSC) and HCM Stock Exchange (HOSE) 3 , which helped investors to start looking beyond the recent anti-corruption drive.

In addition, there were concerns that the State Bank of Vietnam (SBV) would curtail the flow of credit to the real estate market, following recent guidance on this issue. This was another Vietnam-specific factor that had been weighing on the stock market. However, it now appears that the SBV’s guidance urging banks to be prudent in their real estate lending – which was issued in conjunction with the Government’s other regulatory crackdown activities – was comparable to guidance that it has regularly issued over the last few years.

Furthermore, this week a senior official gave guidance during a press conference that the SBV does not aim to curtail the flow of credit to the real estate sector, but is instead monitoring the situation closely. Finally, corporate bond issuance by real estate companies plunged in April, but loan growth to the sector probably outpaced overall credit growth YTD, and developers’ pre-sales are reportedly strong, which will limit their need to borrow money.

Conclusions

The recent bounce in the VN-Index was driven by a thawing of sentiment towards global stock markets, as well as by an easing of investors’ concerns about some Vietnam-specific factors discussed above. Importantly, we estimate that outstanding stock margin levels have fallen by about 30%, which has washed out the most aggressive source of selling pressure in May, paving the way for a further recovery in the market. Finally, we expect earnings growth of over 20% for Vietnam’s stock market this year, although we expect earnings for the companies in our funds will grow by over 35%, which helps explain why those stocks are trading at an even lower P/E valuation multiple than the overall market.