According to a recent study, assets in Exchange-Traded Funds (ETF) are set to overtake hedge funds. Stock-like features, good liquidity, and the ability to easily gain exposure to virtually all markets, are behind this success.

But as usual in finance, there is no free-lunch, and a trade-off is taking place.

For example, let’s look at the Vietnam equity market.

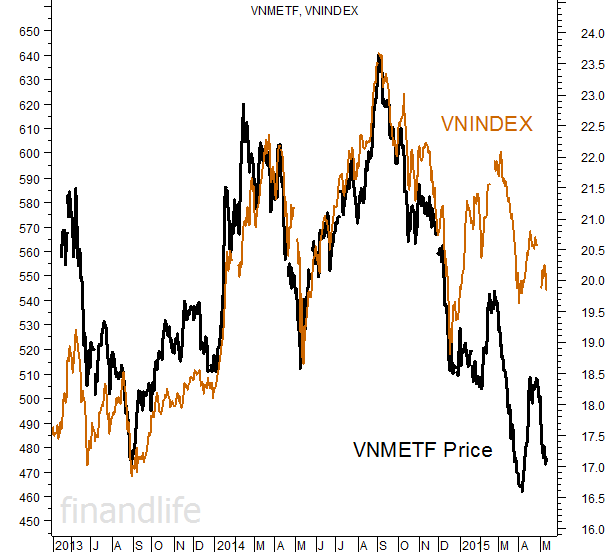

Vietnam is arguably one of the best growth stories at the moment, and as such, the Vietnam Stock Market (VN-Index), is up more than 20% from three years ago. Over the same period, of the two main Vietnam equity ETFs, neither managed to muster positive returns, with being both down well more than 5%. How is that even possible?

The Vietnamese stock market has got a few interesting characteristics. It’s definitely not the most liquid market and, while Vietnam is planning to relax this rule, some stocks are actually capped at 49% foreign ownership.

To be able to offer daily liquidity to their investors, ETFs track indexes composed of stocks which need to be both liquid and without restrictions. By default, this won’t generally include your fast-growing small caps or everyone’s favorite blue chip. Their underlying index will have less than 30 components, whilst the VN-Index tracks 303 equities! No surprise then that the ETF and the market performance can have low correlation.

On smaller markets like Vietnam, the ETFs are a victim of their size too. At some point they represented more than 15% of the free float, pushing the prices up when buying, and down when selling.

Finally ETFs are usually trading at a discount or premium to their index. As this mechanism is known to be driven by arbitrage, it quite often means less return for the fundamental investors. As some Vietnam ETFs can trade a whole week with a premium higher than 10%, entering the market can be expensive from the outset.

With a few trillion invested worldwide in ETFs now, they are uncontestably amazing and highly successful tools. But for a market like Vietnam, where the stock-like features that make the ETFs success could only been achieved by giving up most of the whole market gains, they just don’t work.

Arnaud Lagarde, FRM

Chief Risk Officer at Mandarin Capital Limited