by finandlife02/01/2024 08:33

How is the modernization of the Vietnamese stock market progressing?

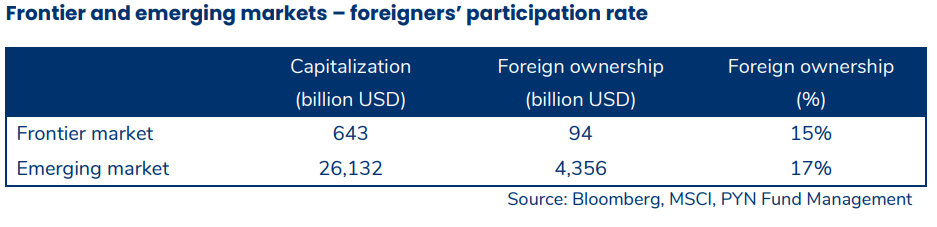

The stock market status of Vietnam has been discussed for at least 10 years, and nothing substantial has been achieved. Index providers MSCI and FTSE Russell classify countries based on how developed their stock markets are, and Vietnam is ranked as a Frontier market. Should Vietnam be included in Emerging markets, it would bring additional foreign institutional investors to the country’s stock market, which could have a positive impact, especially with regard to the privatization of state-owned companies in the coming years.

During the last six months, some real action has finally begun to be seen in Vietnam. The Vietnamese State Securities Commission has been reported to have received a clear directive from the government to modernize the stock exchange. The new trading system KRX was scheduled to be deployed on the 25th of December. Next year, the old-fashioned prefunding trade regulation will be revised, among other things, and perhaps a solution to the issues related to the foreign ownership limit of companies will be found during the next couple of years. It is already clear that the direction is towards the EM market status, but the pace remains to be seen. The attached table shows the investments made by foreigners in emerging markets and frontier markets. The amount of investments in emerging markets is forty-fold when compared to frontier markets. In addition, the number of funds investing in emerging markets is many times the number of those operating in frontier markets.

b0872e9b-3a43-4378-9408-3fe74e2c1700|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PYN, Macro

Economics