Q: What is the yield curve, and what is an inverted yield curve?

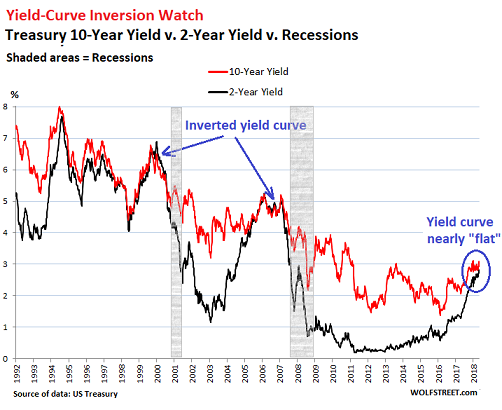

A: The yield curve is graph of the interest rate on bonds as a function of time to maturity. Normally, long-term interest rates are higher than short-term interest rates to compensate for their greater riskiness, so the yield curve slopes upward. Sometimes, the situation reverses: short rates rise above long rates, and the yield curve is said to be inverted.

Q: Why would the yield curve ever invert?

A: The yield curve inverts when bond investors expect short-term interest rates to fall. They are willing to hold long-term bonds, despite the lower current yield, because they are locking in the yield. In other words, current long rates reflect both current short rates and expected future short rates. When investors expect a significant decline in short rates, long rates will be below current short rates.

Q: When would bond investors expect short rates to fall?

A: Remember that short rates are set by the Federal Reserve. So when the yield curve is inverted, investors expect the Fed to be loosening monetary policy.

Q: And why might they expect the Fed to be loosening?

A: Perhaps because they think that the economy is slowing. They expect the Fed would react to a slowdown with looser monetary policy in order to stimulate aggregate demand. As a result, the perception of an upcoming economic slowdown leads to an inverted yield curve today. That is why the slope of the yield curve is one of the variables in the index of leading indicators.

Q: How well does the yield curve predict upcoming economic trends?

A: Pretty well, as compared with other indicators, but it is far from perfect. Remember that economic activity is only one thing the Fed looks at when setting interest rates. It also looks at inflation. So the yield curve also reflects investors' perception of inflation trends. And economic conditions have a great deal of instrinsic uncertainty, which makes even the best indicator far from perfectly reliable.

Source: Greg Mankiw

--------

Bạn đọc có thể truy cập bài, xem góc nhìn truyền dẫn lãi suất đến giá cổ phiếu.

Nhưng cũng đừng quá lo lắng, GS Mankiw cũng bảo rằng nó là phản ứng tâm lý của nhà đầu tư betting khả năng Fed giảm lãi suất ngắn hạn thôi.

FINANDLIFE