Josh Noble in Hong Kong

China is now home to the world’s largest equity markets after the US. Yet extreme volatility is still typical, with benchmark indices often swinging as much as 10 per cent in a matter of hours (trong vài giờ).

China is now home to the world’s largest equity markets after the US. Yet extreme volatility is still typical, with benchmark indices often swinging as much as 10 per cent in a matter of hours (trong vài giờ).

On one day in June, more than $700bn was wiped off (bị xóa sổ khỏi) the value of Chinese stocks. Here are some of the main reasons for the volatility.

What is the investor profile behind China’s equity market?

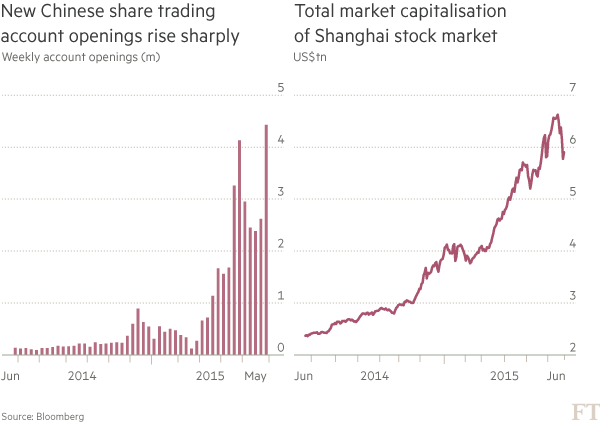

Retail punters account for 80-90 per cent of trading in the Chinese equity markets. Many of them are new to investing — in May alone 12m trading accounts were opened. That means millions of people trading stocks have little or no direct memory of the 2007-8 stock market bubble and crash.

Có đến 80-90% nhà đầu tư là nhỏ lẻ, chỉ riêng trong tháng 5, có đến 12 triệu tài khoản được mở mới, điều đó đồng nghĩa với nhiều trong số đó chưa có bài học từ cơn điên và khủng hoảng 2007-2008.

Even professional fund managers in China often act with very short-term horizons. Many are measured on monthly or quarterly performance, adding pressure to chase the market higher as it moves.

Thâm chí giới quản lý quỹ chuyên nghiệp tại TQ cũng thường hành động rất ngắn hạn.

What impact has State policy had on the market?

Ảnh hưởng gì từ chính sách chính phủ lên thị trường?

Chinese markets are often described as policy-driven. That goes well beyond the direction of monetary policy and deep into securities and banking regulation. Even state-media rhetoric (phương tiện truyền thông nhà nước) has a role to play, as shown by recent supportive messages in various government newspapers. But Beijing’s pronouncements are often open to interpretation, leading to sharp rises and falls in the market as millions of investors try to read the runes.

Thị trường TQ thường được giải thích bởi chính sách điều hành. Điều đó ẩn sau chính sách tiền tệ trực tiếp và tác động sâu hơn vào chứng khoán và chính sách hệ thống ngân hàng. Thậm chí truyền thông nhà nước cũng giữa một vài trò quan trọng.

Prospects of change — As long as the stock market remains a policy lever for the government, and share indices dominated by state-owned enterprises, Beijing’s heavy hand is unlikely to be significantly weakened.

Beijing has tried to encourage more long-term institutional investors into the market, for example by granting freer access to large foreign asset managers or sovereign wealth funds. However, progress has been slow.

Margin finance has been cited as major factor behind the market’s growth. What is this, and how does it work?

Việc cho vay để đầu tư chứng khoán cũng là một nhân tố quan trọng phía sau sự tăng trưởng của thị trường.

Using borrowed money to trade stocks is a common feature of equity markets globally but in China it has rocketed over the past year. Margin trading as a percentage of overall market capitalisation reached a record earlier this year, according to Macquarie — far higher than anything seen in any other market at any time in history.

Điều này là bình thường ở những thị trường khác, nhưng tại TQ nó đã tăng trưởng quá chóng mặt, theo Macquarie, mức cho vay đang cao hơn lịch sự của hầu hết thị trường khác.

High levels of leverage help explain why stocks ran up so quickly over the past year. But that borrowing leaves the stock market prone to (dễ bị) dramatic falls as investors struggle to meet margin calls.

Prospects of change — The regulators have tried to cut the level of margin lending in the system, which has been a key reason for the recent pull back.

Have initial public offerings also helped drive the market?

Có phải IPO cũng là nhân tố dẫn dắt thị trường?

The system for new listings in China remains tightly controlled by the authorities. The state in effect sets the price of new share sales, virtually guaranteeing quick bumper returns (hầu như tỷ lệ lợi nhuận khổng lồ được đảm bảo) for those able to buy in. Even on days when the Shanghai market has fallen sharply, IPOs have typically risen by the daily limit of 44 per cent.

The result is that investors pull cash from the market ahead of new listings, draining billions of dollars of liquidity for a number of days. That can torpedo (làm thất bại) the market, but then push it back up when the funds are unlocked again.

Việc IPO hút 1 lượng lớn tiền ra khỏi thị trường và điều đó có ảnh hưởng lên thị trường.

Prospects of change — Regulators are clearly aware of the need for a rethink, and have promised to hand over IPO approval powers to the stock exchanges, perhaps as soon as this year. However, analysts expect the transition to a more market-based pricing system to take some time.

What are the hedging options?

Thế còn hoạt động của quyền chọn?

Mặc dầu TQ đã giới thiệu hệ thống bán khống cổ phiếu, nhưng nó vẫn chiếm 1 tỷ lệ nhỏ trong thực tế. Chi phí vốn cao và nguồn hàng (chứng khoán) có sẵn ít là một hạn chế.

Although China has introduced a system for short selling stocks, it remains of little use in practical terms. Borrowing costs are high and the availability of stock to borrow is limited. The only real viable way of hedging exposure is through index futures, which is not helpful for those trading specific stocks or sectors such as tech and healthcare. Instead, traders simply have to buy or sell to lessen or increase their exposure, which can result in stampedes when sentiment switches.

And what of prospects for change?

That regulators have tried to introduce shorting at all shows a recognition of the problem. The April debut of options for shorting small-caps was an important step in the right direction. However, the steps taken fall far short of what is needed, suggesting that authorities remain wary of the consequences of making short selling easier.

Relative:

Nguồn: ft.com, finandlife