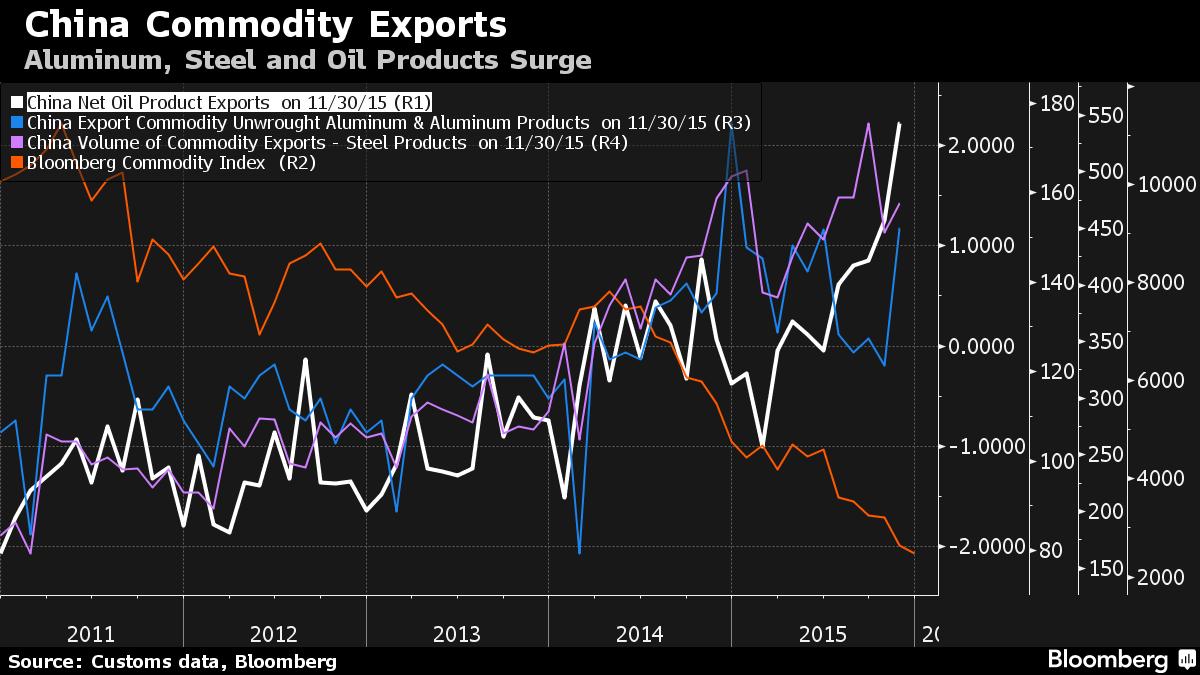

There’s no let-up in the onslaught (attack) of commodities from China.

While the country’s total exports are slowing in dollar terms, shipments of steel, oil products and aluminum are reaching for new highs, according to trade data from the General Administration of Customs. That’s because mills, smelters and refiners are producing more than they need amid slowing domestic demand, and shipping the excess overseas.

Trong khi tổng xuất khẩu quốc gia đang chậm lại thì vận chuyển thép, sản phẩm dầu mỏ và nhôm lại leo lên đỉnh cao mới, nguyên nhân chủ yếu vì các nhà máy, nhà luyện kim và nhà lọc dầu đang sản xuất nhiều hơn nhu cầu trong nước và hàng hóa được xuất ra nước ngoài.

The flood is compounding a worldwide surplus of commodities that’s driven returns from raw materials to the lowest since 1999, threatening producers from India to Pennsylvania and aggravating trade disputes. While companies such as India’s JSW Steel Ltd. decry cheap exports as unfair, China says the overcapacity is a global problem.

“It puts global commodities producers in a bad situation as China struggles with excess supplies of base metals, steel and oil products,” Kang Yoo Jin, a commodities analyst at NH Investment & Securities Co., said by phone from Seoul. “The surplus of commodities is becoming a real pain for China and to ease the glut, it’s increasing its shipments overseas.”

Sự thừa mứa hàng hóa đang trở thành vấn nạn cho Trung Quốc và để giảm bớt gánh nặng, họ đang vận chuyển ra nước ngoài.

Net fuel exports surged to an all-time high of 2.22 million metric tons in November, 77 percent above the previous month, customs data showed. Aluminum shipments jumped 37 percent to the second-highest level on record while sales of steel products climbed 6.5 percent, taking annual exports above 100 million tons for the first time.

Aluminum prices on the London Metal Exchange have fallen 20 percent this year to $1,477 a ton as of Tuesday.

Chinese oil refiners are tapping export markets to reduce swelling fuel stockpiles, particularly diesel. The nation is also encouraging overseas shipments by allowing independent plants to apply for export quotas to sustain refining operation rates and ease an economic slowdown, according to Yuan Jun, general manager at oil trader China Zhenhua Oil Co.

Economic Slowdown

A slowdown in domestic aluminum demand has coincided with the start-up of millions of tons of new capacity in the world’s biggest producer while Chinese steelmakers battling losses have stepped up exports to compensate for shrinking consumption at home as economic growth weakens. The country makes about half the world’s steel.

The flood of Chinese supplies is roiling manufacturers around the world and exacerbating trade frictions. The steel market is being overwhelmed with metal from China’s government-owned and state-supported producers, a collection of industry associations have said. The nine groups, including Eurofer and the American Iron and Steel Institute, said there is almost 700 million tons of excess capacity around the world, with the Asian nation contributing as much as 425 million tons.

Steel Curbs

Low-cost supply from China in Europe prompted (announce) producer ArcelorMittal to reduce its profit forecast and suspend its dividend. India’s government has signaled it’s planning more curbs (control) on steel imports while regulators in the U.S. are planning to lift levies on shipments from some Chinese companies.

It’s not all one-way traffic. Copper imports into the country, the biggest refined metal producer and user, surged to the highest in 22 months in November as traders sought to profit from cheaper prices in London and financing demand rose before the end of the year. China’s crude purchases climbed 3.8 percent and the nation bought 8.8 percent more iron ore.

Source: finandlife|www.bloomberg.com