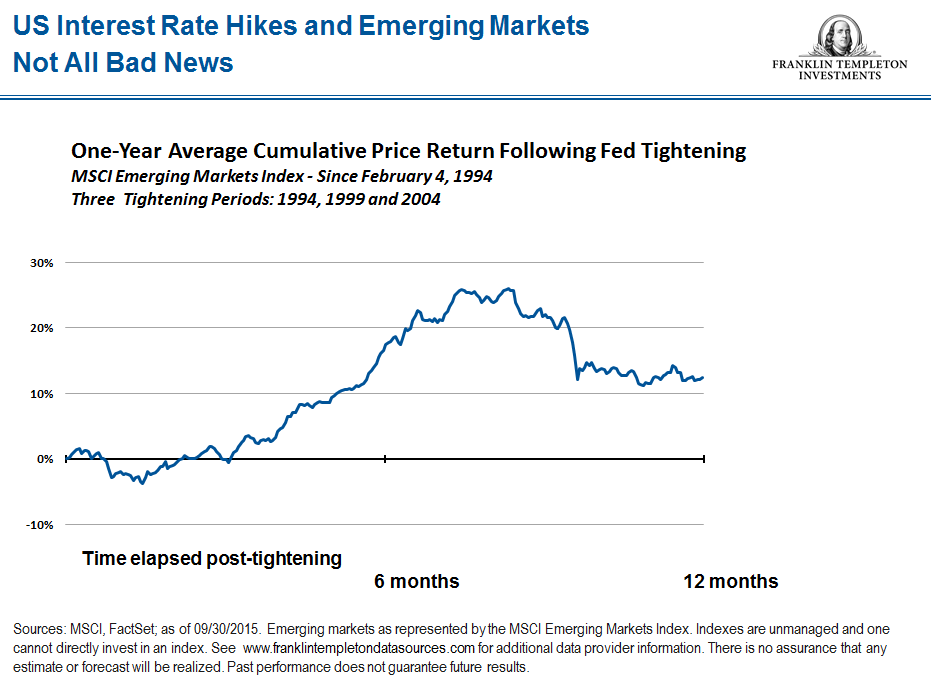

by finandlife02/12/2015 09:14Clearly, this year has been challenging for investors in emerging markets, which have generally underperformed developed markets. However, we have seen recent data showing the trend of asset outflows may be reversing as more investors are putting their money back to work in emerging markets. This is encouraging to us, but even if the type of volatility we saw this summer flares up again, by no means do we feel it’s time to abandon the asset class. We consider many of the factors driving recent volatility in emerging markets to be temporary and compounded by typically low summer liquidity—thus we believe we have grounds to be optimistic longer term.

What Are the Risks?

All investments involve risks, including possible loss of principal. Foreign securities involve special risks, including currency fluctuations and economic and political uncertainties. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Smaller-company stocks have historically had more price volatility than large-company stocks, particularly over the short term.

Source: http://mobius.blog.franklintempleton.com/