by finandlife03/01/2024 08:52

Nguyen Duc Hung Linh

2 years ago, suggesting VietQR for money transfers was met with blank stares. Today, it's everywhere, from shopping malls to wet markets. The rapid popularity of VietQR is phenomenal, especially when compared to the hefty marketing budgets burned by fintech companies. 🤔 Why has VietQR become so popular so quickly?

1 Merchants prefer VietQR for its zero fees and instant money reception. In June 2021, NAPAS launched VietQR alongside NAPAS 247, a service enabling instant, real-time, and zero-fee money transfers between bank accounts. NAPAS 247 disrupts fee-based QR payment services offered by E-wallets or payment gateway companies like VNPay and MOMO.

2 Commercial banks also find VietQR beneficial; more merchant use means more Current Account and Savings Account (CASA) for banks 💰. Banks distribute printed QR codes for merchants, turning hundreds of thousands of bank employees into inadvertent VietQR promoters.

3 End consumers might feel indifferent initially, but more are leaning towards VietQR. Peer-to-peer money transfers through bank apps' QR code generation and scanning make transactions easier. People tend to stick to what they use more often.

What's the impact on the payment landscape?

1 As VietQR gains traction, the usage of VNPay or MOMO diminishes. Fintech giants are compelled to explore alternative strategies for customer retention and revenue generation. VNPay leverages unique features within commercial banks' apps, while other e-wallets strive to evolve into super apps. The path to profitability for these fintech companies has undoubtedly become more challenging.

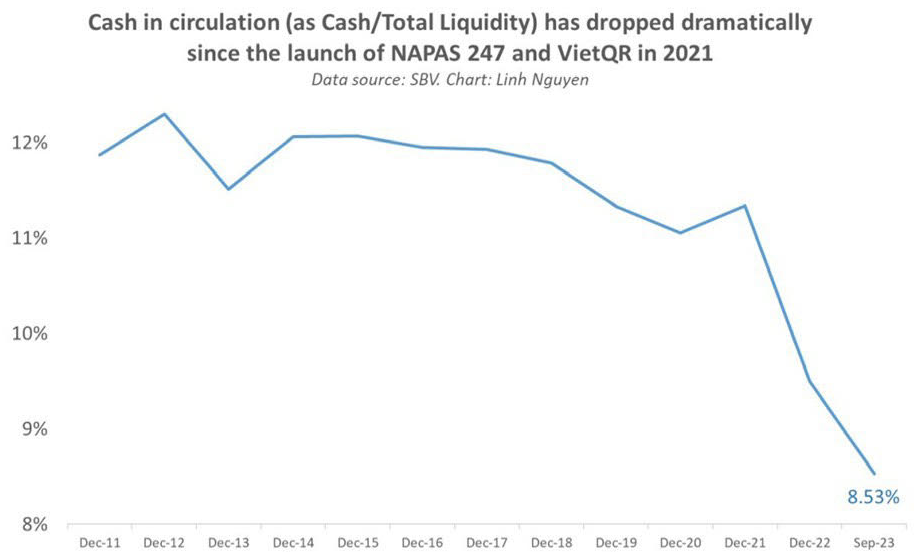

2 Here's a little-known impact: ↘ the sharp decline in cash circulation since 2021. It plummeted from over 11% to 8.5% by September 2023. To put it in perspective, it took a decade from 2011 to 2021 to reduce by roughly 1%. In contrast, the last two years saw a remarkable ~3% drop⏬. NAPAS had a clear mission statement: "to promote non-cash payment." Their journey was challenging but now the tide has turned. VietQR emerges as a pivotal player in this success story. 👑 🤔 What's VietQR? VietQR is a trademark for payment and money transfer using QR codes in Vietnam. VietQR belongs to NAPAS (National Payment Corporation of Vietnam). NAPAS is a unique entity, with 49% ownership vested in the State Bank of Vietnam (Vietnam’s central bank) and the remaining 51% distributed among 15 major commercial banks in Vietnam. Beyond Vietnam, VietQR works with a few foreign bank apps from Thailand and Cambodia. This lets Thai and Cambodian tourists use their bank apps to scan and pay in Vietnam using their own currencies. What are your thoughts on this digital revolution?

bf1d4f4d-f559-4f6f-a163-13bf4c839308|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: Napas, 247

Stocks