Meir Statman draws analogies (sự tương đồng) between investor behavior and nutrition, in his book What Investors Really Want. For example, we all know that the best way to eat nutritious, low-cost meals is by dining on healthy food at home. But that’s just not fun for most of us: We’d much rather indulge (thích thú) in rich foods at expensive, fancy restaurants.

Có sự tương đồng giữa hành vi nhà đầu tư và vấn đề dinh dưỡng. Ví dụ, chúng ta đều biết cách tốt nhất để ăn bổ, rẻ là nấu tại nhà. Nhưng rõ ràng đó không phải là cách vui cho mọi người, chúng ta thích dùng bữa tại những nhà hàng mắc mỏ, được trang hoàng hơn.

Investors want what Statman calls “utilitarian benefits.” We know that a diversified, low-cost portfolio is theoretically best, but we’d rather have the amusement (trò giải trí) and bragging (khoe khoang) rights of expensive, risky investments like hedge funds and specialized equity managers.

Chúng ta ai cũng biết việc đa dạng hóa, và danh mục chi phí thấp là một lý thuyết hoàn hảo, nhưng chúng ta thích trò giải trí và quyền khoe khoang mắc mỏ, những thương vụ đầu tư mạo hiểm như các hedge funds và những nhà quản lý chứng khoán chuyên nghiệp.

In keeping with the dining analogy, investment advisers are like waiters catering (phục vụ cho) to the diverse appetites (sự thèm ăn) of their clients. Clients want their advisers (waiters) to guide them through their investment choices (menu selections). A successful financial adviser recognizes that the ingredients for satisfying clients are as follows:

Nhà tư vấn như các phục vụ bàn ở nhà hàng, khách muốn họ hướng dẫn việc chọn lựa menu, nhà tư vấn tài chính thành công nhận biết những thành phần cho sự thỏa mãn khách hàng.

Menu: A successful waiter needs a good menu with tasty selections that serve a variety of palates (khẩu vị). A successful financial consultant needs a variety of solutions that meet a wide range of investor needs.

Menu: Nhà tư vấn tài chính cần những giải pháp đa dạng để nói cùng tiếng nói với khách hàng.

Selection: A successful waiter helps diners select something from the menu they will like. A successful consultant identifies client needs and matches them to a solution that will make them happy.

Lựa chọn: Nhà tư vấn thành công xác định nhu cầu và đáp ứng giải pháp giúp khách vui.

Follow up: A successful waiter asks for feedback and makes changes as necessary. A successful financial consultant monitors progress toward the achievement of goals and recommends changes along the way.

Theo sát: người bồi bàn hỏi cảm nhận của khách để thay đổi khi cần. Người tư vấn đầu tư theo dõi tiến trình đạt mục tiêu và khuyến nghị thay đổi trong suốt thời gian đó.

Menu of Models

A tasty menu item has quality ingredients and is skillfully prepared. In investing, we create models, each designed for a specific type of investor. Risk is the quality ingredient, and packaging that risk to provide the highest return is the skillful preparation.

Menu ngon miệng có những thành phần chất lượng và được chuẩn bị đầy kỹ năng. Trong đầu tư, chúng ta tạo ra những models, mỗi cái được thiết kế cho từng loại khách hàng. Rủi ro là thành phần chất lượng, và việc gói rủi ro đó lại để có thể cung cấp một mức sinh lãi cao nhất là bước chuẩn bị đầy kỹ năng.

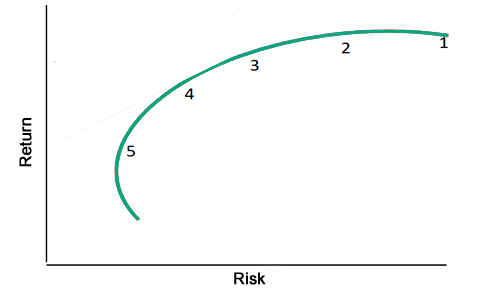

Most models start by identifying points on the efficient frontier, like the five points shown in the graph below. Each numbered portfolio theoretically provides the highest return for the indicated level of risk. Harry Markowitz won a Nobel Prize in 1990 for his theory of portfolio choice, recognized as the birth of modern portfolio theory (MPT). The efficient frontier is the centerpiece of MPT.

Efficient Frontier

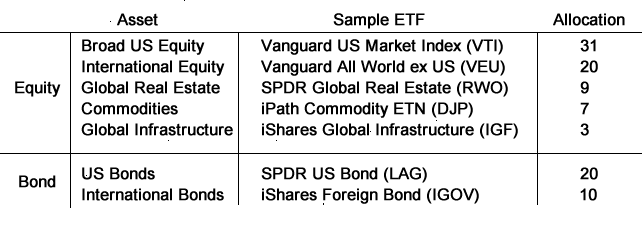

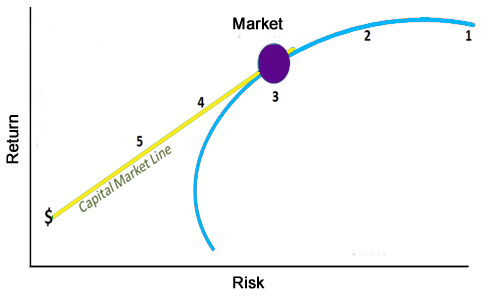

Most do not realize that another Nobel Prize-winning theory refines the efficient frontier. William F. Sharpe also won the Nobel in 1990 for his capital asset pricing model (CAPM), which demonstrates that risk control is best achieved with cash, among other things. As shown in the graph below, the capital market line, which blends the “market” with cash, dominates the efficient frontier by providing higher returns for the same level of risk. (It’s important to realize that the “market” in this context is the entire world of risky assets, not just the US stock market.) This represents a challenge, because we can’t know the real composition (cấu tạo, thành phần) of the current market, but we can guess. Here is an example:

Example of a World Market Portfolio Estimate

Capital Asset Pricing Model (CAPM)

Other refinements (cái hay) to models are like the house specialties that set some restaurants apart. Models can be refined in two ways:

Market views can adjust asset weightings — timing. For example, the current bond manipulation to zero interest argues for shorter duration bonds because there is no reward for taking duration risk.

Active rather than passive managers can be used. Investors want active managers, and advisers want to give clients what they want, but it’s very difficult to identify skillful active managers. Advisers don’t want to spend the time, energy, and money that it takes to identify skill (as summarized in this infographic), so active managers who underperform are the norm (chỉ tiêu).

Choosing a Model

Selecting a model is like placing a dinner order. There are three ways in which investors can choose:

Risk-based is like the diner who asks the waiter for a recommendation. Investors don’t know their risk capacity. They want their advisers to tell them. Risk questionnaires can help, with the guidance of an adviser.

Rủi ro cơ bản giống thực khách người hỏi bồi bàn khuyến nghị món ăn. Những nhà đầu tư không biết kích cỡ rủi ro của họ. Họ muốn những nhà tư vấn cho họ biết. Những câu hỏi rủi ro có thể giúp ích, với hướng dẫn của một nhà tư vấn.

Age-based uses a target date fund glide path to identify an appropriate asset mix. It’s like older diners ordering bland, soft food versus youngsters ordering the more exotic dishes.

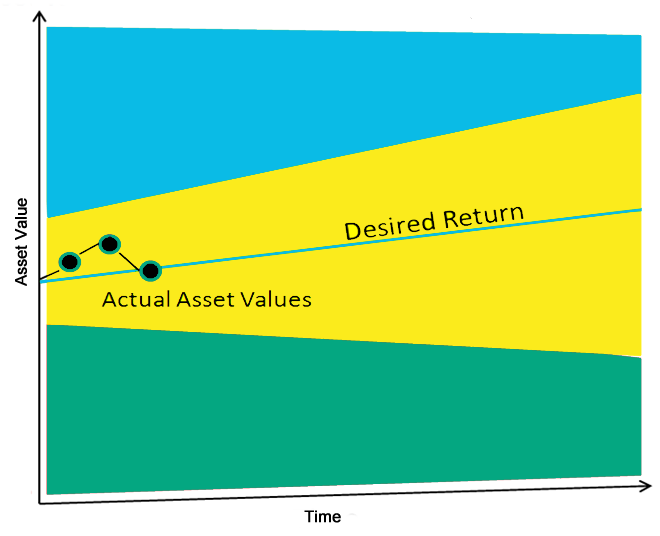

Goals-based uses a model that is expected to earn a return that will produce the desired objective. Calculators help advisers solve for the return that will match cash flows with targeted ending wealth. Then a model is selected that is expected to earn at least that desired return. Goals-based investors are like discriminating diners seeking a culinary treat. Even though they are the most challenging, they are also the most likely to appreciate good service.

Follow Up

Just as waiters help diners through the various courses of the meal, advisers help their clients navigate through phases of life, monitoring progress toward the achievement of objectives and making changes as necessary. We call this “portfolio navigation.” If we’ve exceeded expectations, we can save less (spend more) and/or reduce risk. If we’re trailing expectations, we can save more (spend less) and/or increase risk. Investors have choices.

Portfolio Navigation

Investors want to make money, just as diners want great food and great service. But both also want to have fun and brag about the experience. Successful advisers are like successful waiters: Both require three key competencies that, while easy to understand, are challenging to do right.

Nhà đầu tư muốn tạo rao tiền, như những thực khác muốn đồ ăn và dịch vụ tuyệt hảo. Nhưng cả hai đều muốn vui vẻ và được khoác lác về những trải nghiệm. Những nhà tư vấn thành công giống những bồi bàn thành công: Cả hai cần đến ba tố chất, dễ hiểu nhưng đầy thử thách để làm đúng.

Source: Ron Surz, blogs.cfainstitute.org