by finandlife26/11/2019 10:40Key Summary

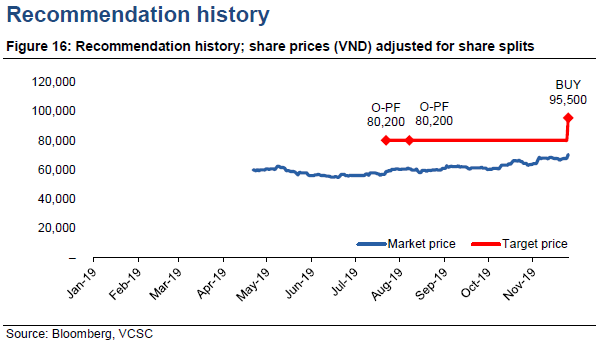

- We upgrade PTB from OUTPERFORM to BUY as we raise our target price by 19% due to a rollover of our valuation to YE2020 and increased 2021F-2022F NPAT-MI; this is despite trimming our 2020F NPAT-MI forecast by 3%, mainly due to higher interest and SG&A expenses.

- We raise our 2021F-2022F NPAT-MI by 11% on average as (1) we add the new quartz business to our forecasts and (2) selling prices of PTB’s residential project exceed our projections by ~25%.

- We expect quartz will start generating revenue in mid-2020 and contribute 8% to gross profit in 2022F, partly bolstering our forecast of a 2020F-2022F CAGR of 17% for the stone segment.

- In addition to a rising contribution from quartz business, our forecast of accelerating EPS growth in 2020F-2021F is premised on (1) the fact that 2019 EPS is diluted by a 5:1 rights issue carried out in Q2 2018 and (2) a projected contribution from the residential real estate project in 2021.

- PTB looks attractive with a 2020F PER of 6.9x vs a 5Y average peer TTM PER of 10.7x. Still, we maintain our target price at a 20% discount to our SOTP valuation given PTB’s conglomerate structure, new foray into real estate, weak free cash flow and limited information disclosure.

- Potential downside risks to our positive view: slowdown in domestic construction activity; new tariffs on Vietnamese wooden furniture; sluggish real estate and quartz execution.

VCSC Research

d0f6d3e3-c91d-4382-816e-a9edff790ef6|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PTB

Stocks