NKG has announced Q2 earnings and accumulated 6 months first half of 2015 with quite positive results. We are pleased to update investors following a few key points:

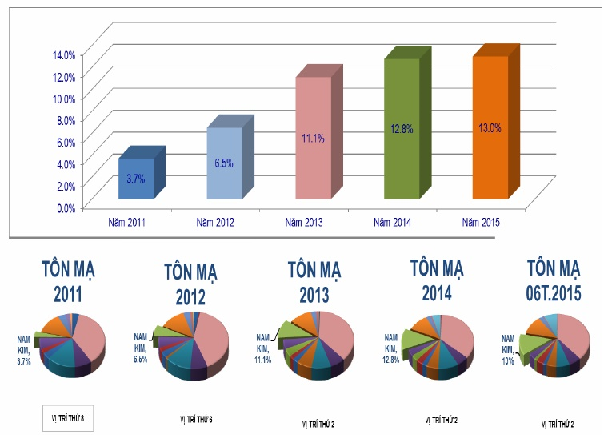

- Galvanized corrugated steel (GCS) still the main product of the company with the proportion of 75% in the structure of commodities. According to the first 6 months VSA, GCS company’s market share accounts for 13%, continued to maintain the No.2 country after only HSG.

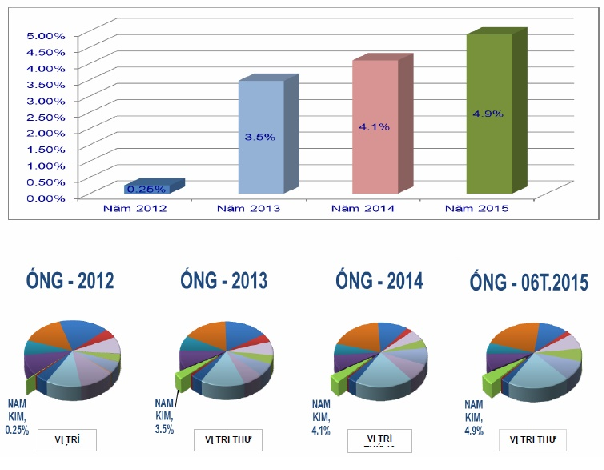

- Meanwhile, the proportion of Steel Box (SB) structures 21% of company goods, also recorded continuous growth over the years. Nam Kim SB accounted for 4.89% in the total sales volume of enterprises in Vietnam Steel Association and among the top 10 in production.

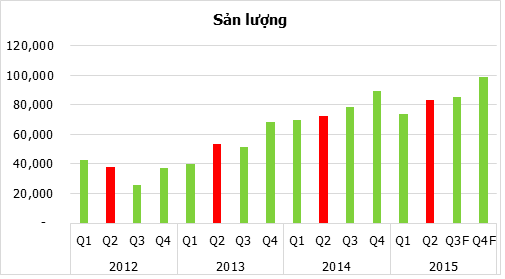

- The output of the whole company 6 months of this year reached 157,000 tons, an increase of nearly 11% compared to 6 months last year. However, Net sales only reached approximately 2,500 billion, down 16.7% compared to 3,000 billion of the same period. Cause by Hot rolled material input prices fell sharply forced the company to reduce prices to customers which makes net sales decreased in value.

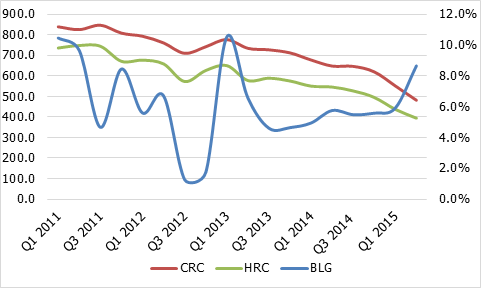

- Gross profit (GP) Q2 this year has improved strongly to 8.6% against 5.8% compared to just 5.8% in the same period last year. And this is the key help the company profit growth this year impressed. The reason for the improvement of the GP Q2, partly we think that speed Q2 sales prices of the company this year (-24.6%) slower pace of HRC input prices (-27.7%). On the other hand, the new cold rolling mill in operation helped companies active in cold rolled materials instead of purchasing from other units as before. And we appreciate this is not the main reason for GP current improvements that will continue to maintain a positive future.

- In addition, interest expense and other operating expenses were reduced, making the final result increased profits. Particularly Q2, EAT was 45.3 billion, up more than 2 times the 24.4 billion of Q2.2014. In 6 months of this year, EAT reached 65.8 billion, an increase of almost 2 times over the same period. EPS ttm reached 2,700, with a closing price 15,300 VND, P/E ratio is only about 5.7.

- Thus, after the 6 months of, the company has completed expansion investment factory Nam Kim 2 with a closed process, bringing total capacity present to 450,000 tons finished product per year. Nam Kim 3 Projects slated for the product in September 2016 and the end of 2017 to complete the whole project, the company increased the capacity by approximately 2 times compared to today.

- Based on the current situation, we expect the 2015 production of approximately 340,000 tons products, increased 10% compared to 2014 and down 15% compared to the company plan. And based on careful, we also reduced the forecast Net sales value of the year to 5,432 billion (previous forecast was 7,160 billion), down 7% compared with the implementation of 2014, due to concerns selling price will continue at low levels.

- However, GP will continue to hold high level (8.1%), due to the closed process. While financial expenses and cost of sales, which we expect will increase by the company’s use of debt increases and expand advertising sales until the end of the year. Accordingly, EAT will be approximately 150 billion, up from a previous forecast of 100 billion.

- The company expects to end the year to complete the issuance of 20 million shares to strategic shareholders with price >= 15,000 VND per share as plan. Thus, with 150 billion EAT, we expect diluted EPS of 2015 near 2,400, up 25% despite dilution level is over 58% compared to 2014. With the current price, the P/E will be approximately 6.4, we recommend BUY with a price level around 15,000 VND or below, with the target P/E 8 is 19,000 VND in the last 6 months.

Analyst Nguyen Ngoc Thanh, VFS Research