by finandlife22/04/2015 11:15

PTB has just announced the business results of Q1.2015 and business plan Q2.2015. (Link: http://images1.cafef.vn/…/ptb-nghi-quyet-hdqt-ve-ket-qua-ho… )

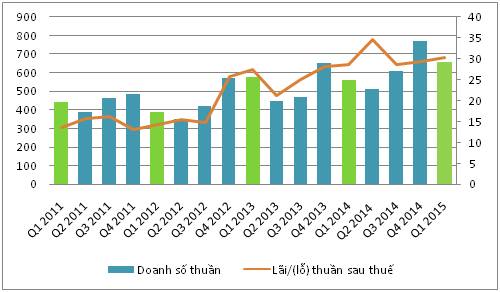

Accordingly, Revenue Q1.2015 reached 652.3 bn, an increase of nearly 17% over the same period last year consolidation, completing 25% of the plan. Profit before tax reached 37.8 bn, an increase of 8.5% compared with the same of consolidation and completion of 27% of the plan.

There are good growth is due to overall growth of the three core businesses, including The STONE and WOOD with superior growth (with the same 23%) while Toyota CAR grew 8% compared to the same period one year ago.

Although not provide detailed figures but we expect gross profit margin (GPM) in the first quarter of this has improved thanks to the growth of STONE and WOOD, which GPM relatively high compared with Car’s GPM is usually low.

And of course the cost of sales will increase while the cost of finance and management is kept constant. Moreover, the company will receive additional assistance from Toyota sales and other income from it will also increase correspondingly. We also announced that the company data is the parent company data by comparing them based on unconsolidated data of the previous year.

While in 2014, The subsidiarie companies contribute more than 2% of sales and 10% of consolidated profit after, so we expect the data can be increased when the company figures out the final report. Company also lauched a business plan Q2.2015 with 640 bn of revenue and 41 bn profit before tax. Normally, Q2 is low season of the annual and the company’s revenue decrease is understandable.

Based on the data of the company announced, EPS ttm for Q1.2015 to nearly 9,300, with the market price of the day 21/4 (60,000 VND), P/E reached 6.5 – quite attractive at the moment. We recommend HOLD on this stock.

Analyst Nguyen Ngoc Thanh, VFS Research

6953b465-dab7-43d1-8245-73637a4a6b96|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PTB

Stocks