by finandlife29/12/2014 10:47…but the prospects for frontier markets may be less gloomy than some reports have suggested.

Michael Levy, investment manager for Barings’ frontier markets fund, admits many investors have soured (trở nên khó) on frontier markets, but argues that the reaction is unjustified (vô lý) and that both importers and exporters of oil could potentially benefit from the oil price decline.

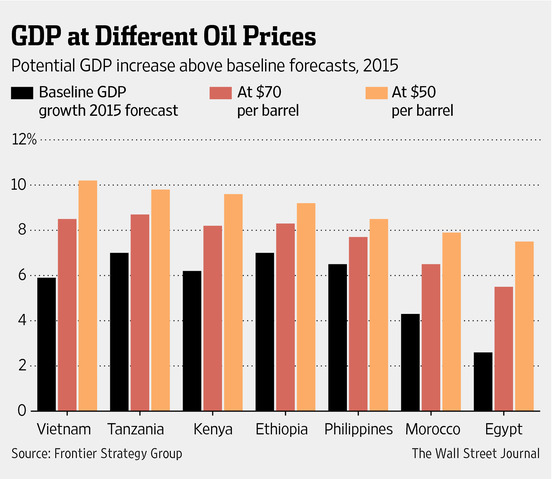

In its analysis of impact of cheaper oil on the GDP outlook for frontier and emerging markets, Washington, D.C.-based Frontier Strategy Group (FSG) predicts a clear split between net-producers and consumers of oil. If oil settles at $50 per barrel, FSG says it could almost halve (giảm 1 nửa) Nigeria’s GDP growth next year, from its forecast of 6% to just 3.4%. For Iraq, the impact could be even more severe, with GDP growth reversing from FSG’s baseline forecast of 3% to a contraction of almost 2%.

Oil importers, though, should see a powerful boost. According to the FSG analysis, Vietnam’s 2015 GDP growth could jump from the currently forecast 5.9% to 8.5%. Oil prices stabilizing at $50 could help propel (đẩy) Vietnam’s GDP growth over 10% next year.

Barings’ Levy believes companies in countries such as Bangladesh and Pakistan, major purchasers of oil, will benefit from the impact that lower oil prices will feed through to an improvement in consumers’ spending power. “Consumer companies in these markets should see a beneficial increase from [higher] disposable income (thu nhập khả dụng, thu nhập còn lại sau chi tiêu cho các hóa đơn) and margin improvement as they benefit from the decline in some of the input costs,” he says.

Other firms that should benefit from the decline in oil prices are producer of health and beauty products, and alcoholic beverage company.

Wall Street Journal

da172401-7b79-49eb-89c9-78c1eda2c580|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: Oil

Economics