"Health is the greatest possession. Contentment is the greatest treasure. Confidence is the greatest friend. Non-being is the greatest joy." Lao Tzu

Introduction

Investing through the cycle

Still, we don’t underestimate the challenges of a world—a global economy and global markets—in transition. Neither do we underestimate the potential opportunities going forward. After all, investing through the cycle means investing for the next cycle.

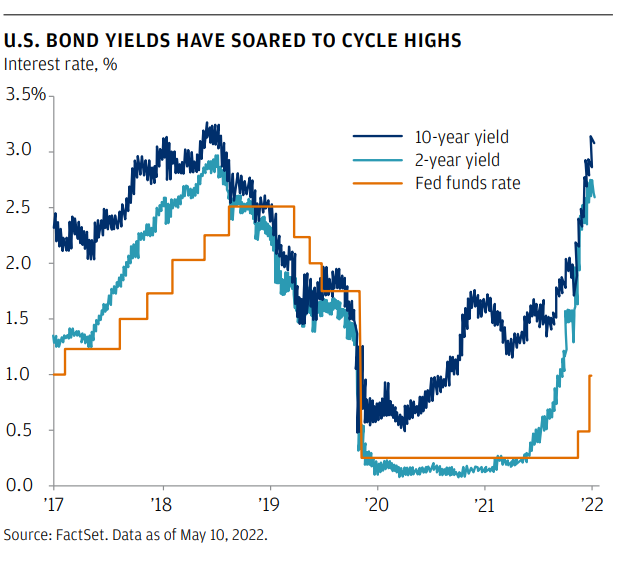

Campaign against inflation and the end of easy money

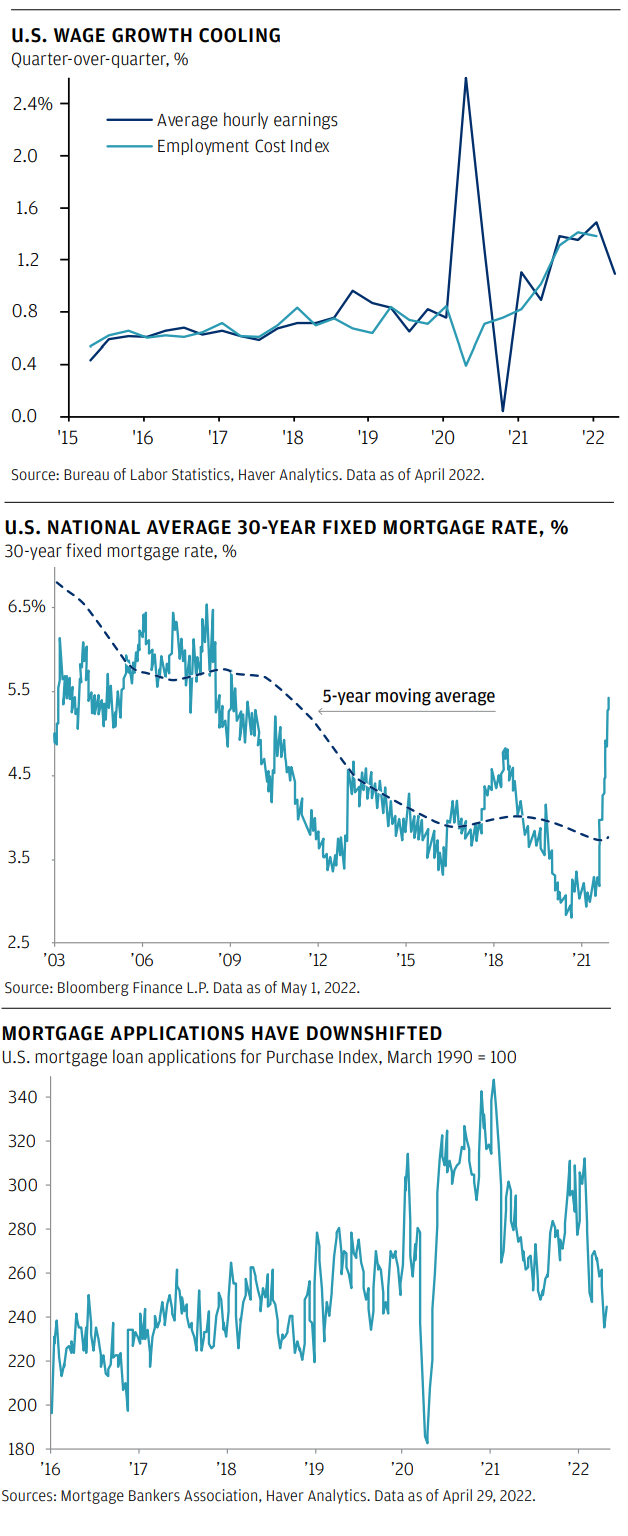

War in Europe and commodity supply shocks

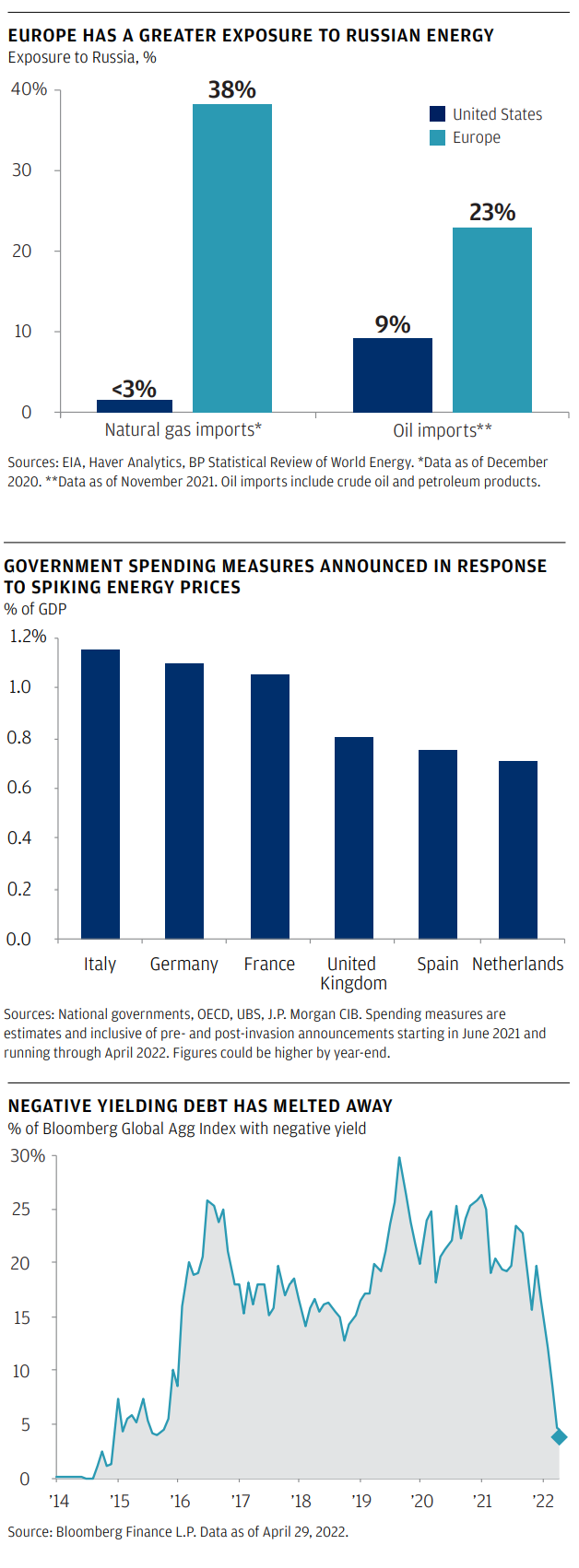

COVID-19 in China and the global fallout

Preparing portfolios for this cycle and the next

We think investors can take three steps to prepare goal-aligned portfolios to potentially weather this cycle and next:

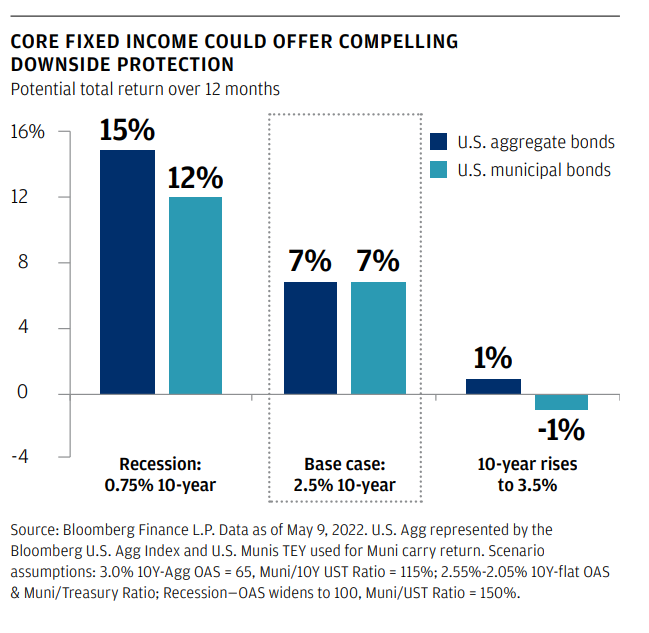

Rely on core fixed income as a portfolio ballast

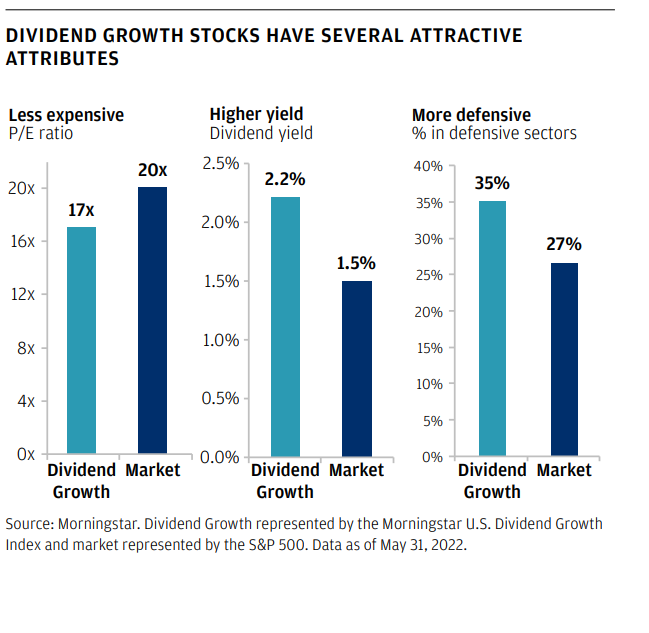

Prioritize balance and quality in equity portfolios

Position for structural change

As we see it, the next cycle will likely feature reconceived and restructured global supply chains. For more than 30 years, supply chains were increasingly globally integrated. Especially after China joined the World Trade Organization (WTO) in 2001, much of U.S. manufacturing moved offshore. That tide may be turning as geopolitics and the potential for future pandemics prompt business leaders to add resiliency.

In the next cycle, manufacturers may increasingly bring their factories onshore (or nearly onshore) and make them more “autonomous” (more productive and efficient). For investors, this means increased opportunities for robotics and related hardware and software.

Conclusion

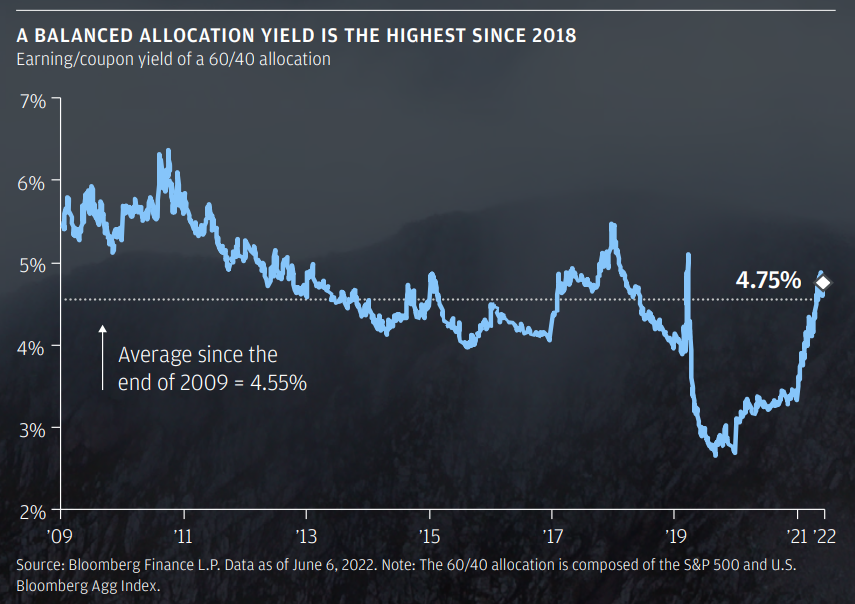

Discipline through discomfort

Today’s investing environment may be uncomfortable for investors, but that doesn’t mean it can’t be profitable. In fact, at current levels, the entry point in stocks and bonds looks to be the most compelling in several years. Investors don’t seem to be overpaying for corporate earnings growth, and fixed income provides a viable yield and important protection against a more severe economic downturn.

The risk of a hurricane—a potential Fed policy error and the risks emanating from war in Ukraine, and lockdowns in China—seems well understood by investors. This also probably means that the downside scenarios are at least partially reflected in current prices. It leaves a smaller chance that one of these risks takes markets by surprise and causes more material weakness.

In fact, the bar seems to have been reset lower for what could constitute a positive surprise. If inflation does reach a trend-like pace and the labor market cools, the Fed may not raise rates as far, or as fast, as investors currently expect. Growth, driven by consumers and corporations, has held up admirably through the headwinds. Investors could well uncover opportunity amid the volatility.

We believe long-term investors will be rewarded for enduring the volatility that will likely define markets over the remainder of the year.

But more importantly, in periods of increased volatility and opportunity, you’ll want to revisit your goals-based plan. Your decisions about risk should be intentional, based on the purpose of the “buckets” in your plan. In this way, nearterm goals are more insulated from volatility, those meant to fund your highest priority goals in the medium term are positioned for growth and stability, and those with the longest time horizons or purposes beyond your lifetime can be positioned more opportunistically.

As always, we believe designing and revisiting a goals-based plan is the most impactful action you can take to help improve the likelihood of achieving your financial goals.

J.P Morgan

Private Bank