This article is copied from seekingalpha.com, author Tran Thang Long, BSC Research.

Thanks for the nice work.

---------------------

Summary

Vietnam’s macroeconomic stability and growth stand out from other emerging and frontier countries (GDP +6,5%, Export +9%).

TPP, RCEP and other 15 FTAs make Vietnam one of the most open countries in terms of FTA.

Vietnam's stock market still has an attractive valuation and growth potential (P/E 10.6 and EPS grow 10%).

The world had experienced many difficulties in 2015, with economic slowdown, stagnant production, while unemployment rates are increasing in many regions. But Vietnam has been rising in both economical and stock market aspects.

1. Vietnam stock market

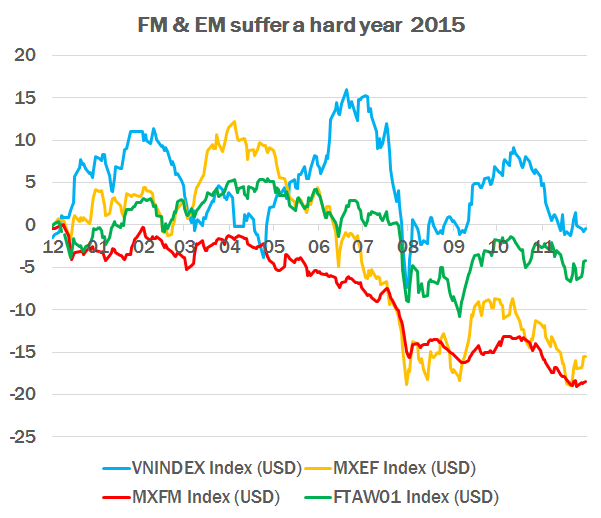

The main index VN-Index rose 6.1% in 2015. Vietnam's stock market achieved the 5th highest growth among Asian countries while emerging markets and frontier markets experienced deep falls such as Straits Times Index-Singapore (-15%), SET Index- Thailand (-14%), JCI Index-Indonesia (-12%).

Source: Bloomberg

But liquidity and the size of the stock market still may be the biggest issues for foreign investors:

· Total market capital reached USD 60 billion, equivalent to 34% of GDP and increased 17.3% yoy.

· Average daily turnover of about USD 100 million.

· 27 listed stocks have daily turnover of more than a million USD.

· Vietnam has foreign ownership limitation of 30% for banks and 49% for listed stocks. Thanks to Decision 60/2015, Vietnam started lift up FOL for some sectors in 2015.

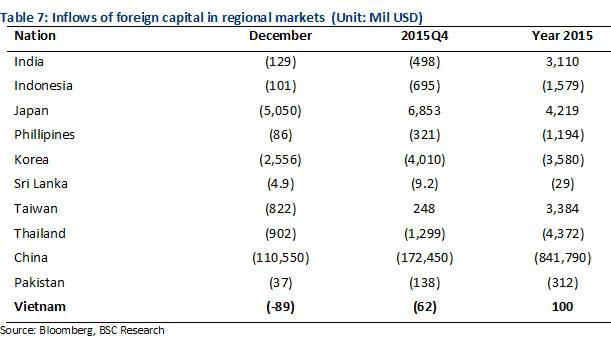

Despite global turmoil, Vietnam's stock market in 2015 had attracted foreign inflows, while foreigners net sell in most emerging and frontier markets.

· Foreign investors owned USD 14.3 billion accounting for 24.9% of Vietnam's stock market capital.

· Foreign Inflows were ~USD 100 million in 2015 (-27.9% yoy).

· Inbound M&A in Vietnam reached USD 5.2 billion in 2015 (+49% yoy).

Source: Bloomberg

Valuation comparing with other regional stock markets

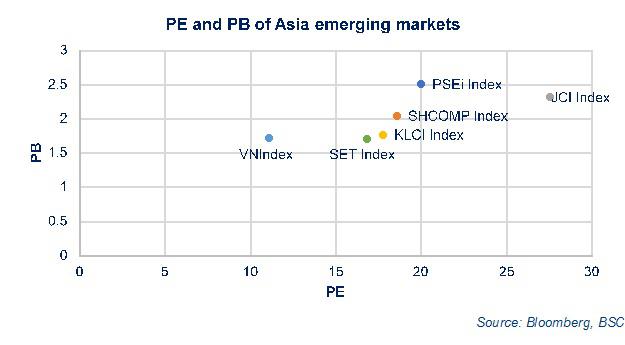

Compared to the Southeast Asian (Emerging stock markets), Vietnam's stock market has always been valued at a discount in terms of P/B and P/E. With the EPS annual growth rate around 10%, the low P/E ratio makes Vietnam's market quite attractive.

Source: Bloomberg, BSC

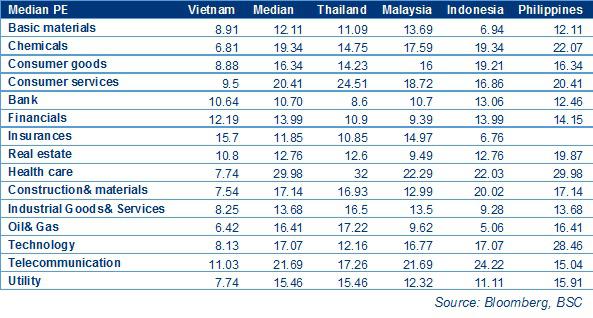

Vietnam's sectors, in general, are being priced attractively in comparison with other Asian emerging countries like Thailand, Malaysia, Indonesia, Philippines and China. Sectors having deep discounts are telecommunications, technology, public services, chemicals, consumer services, etc.

Source: Bloomberg

2. Vietnam's macroeconomy is turning around.

Economic growth was strong in the last 5 years; Vietnam is becoming a bright spot in 2015. The gross domestic product (GDP) grew by 6.68% yoy. GDP growth expanded quarter to quarter (by 6.12% yoy in the 1st quarter, 6.47% yoy in the 2nd quarter, 6.87% yoy in the 3rd quarter, and 7.01% yoy in the 4th quarter). GDP prolonged recovery in the 3rd consecutive year and made Vietnam again one of the fastest growing economies.

· Industrial production index (IP) rose by 9.8% yoy (the highest in the last 4 years).

· PMI still showed the positive state of the manufacturing sector in 2015 since the average index reached 51.55 points.

· Consumer price index (CPI) rose by 0.6% in 2015 (lowest in 14 years).

· Retail sales rose by 9.5% yoy in 2015.

In 2015, Vietnam completed negotiations for two major FTAs

This includes Free trade agreement Vietnam - EU (EVFTA) and the Trans-Pacific Partnership (TPP). Up to now, Vietnam has signed 17 FTAs, that make Vietnam exposed to 62% of population and 80% of the world GDP. These FTAs have been getting significant impacts on medium and long-term growth in both the politics and economy of Vietnam.

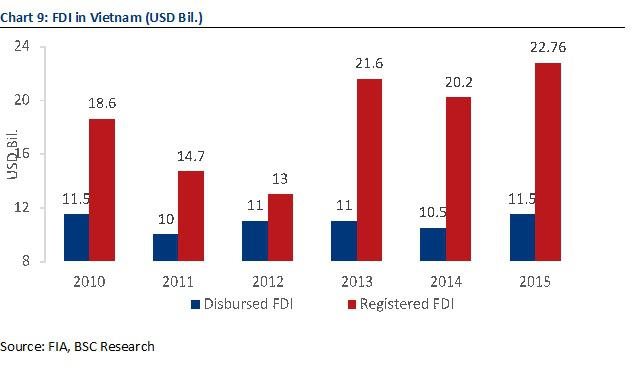

· FDI disbursement in 2015 reached USD 14.5 billion, up 17.4% yoy (highest level since 2011).

· Registered FDI in 2015 was USD 22.76 billion, up 12.5% yoy.

· Export turnover in 2015 reached USD 162.4 billion, up 8.1% yoy (the only place in Asia where exports grew in 2015)

· Import turnover in 2015 was USD 165.6 billion, up 12% yoy. The total value of the trade deficit was USD 3.2 billion

Monetary policies in 2015 was stable, and became the foundation for economic growth.

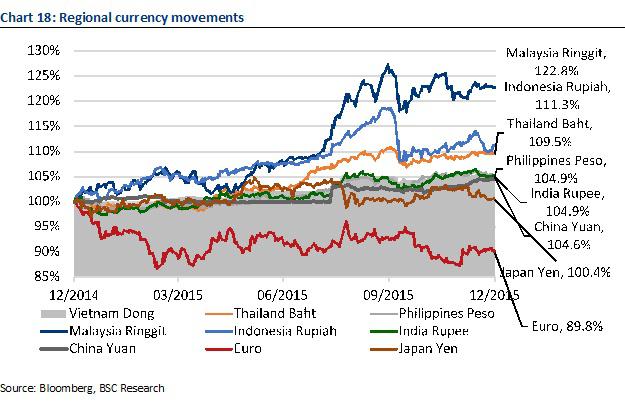

· VND was relatively stable compared to other currencies in the region. Relatively, VND's depreciation of 5.07% was similar to INR (Indian Rupee), PHP (Philippine Peso), and CNY (Chinese yuan).

· Interest rate level decreased 0.2%-0.5% in 2015 slightly to 6.5-6.6% per year.

· Non-performing loans of banking system fell to 2.72% (the restructuring target of NPL was 3%).

3. How to Invest in Vietnam's stock market

There are 2 ways for foreigners to invest in Vietnam's stock market via (1) ETFs and (2) open a trading account at a local broker.

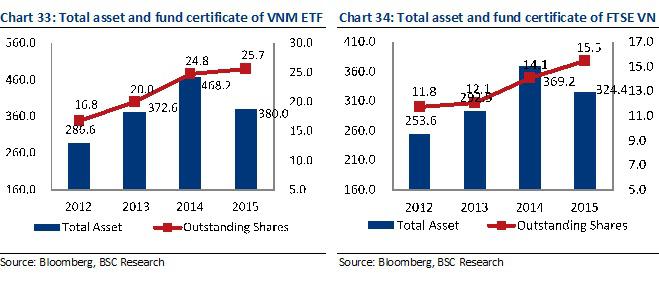

(1) ETFs: There are only a few ETFs that have exposure to Vietnam. Two of the biggest are Market Vectors Vietnam ETF (NYSEARCA:VNM) listed in the US and the FTSE Vietnam listed in EU and Asia.

· Vaneck VNM - NAV: USD 338 million invest in 31 stocks

· FTSE Vietnam (FTSE) - NAV: USD 353 million invest in 21 stocks

(2) Open a trading account: 3 steps

· Register Indirect Investment Capital Account (IICA) at State Bank of Vietnam (SBV). Your custodian bank can do that for you.

· Trading Code Application at Vietnam Securities Depository (VSD).

· Open a Trading Account at a local broker house

4. Conclusion

To sum up, Vietnam has been rising in both economical and stock market aspects. Its economy has been in a lagging cycle since the 2008 financial crisis. Additionally, all the FTAs will make Vietnam policies and its economy attractive to the western world in the long term. With GDP expected to be above 6.7% in 2016, Vietnam will be again one of the fastest growing economies.

We expect a 10% increase in EPS thanks to stronger private firms and a lower corporate tax rate in 2016. Besides stronger growth in earnings, the stock market will benefit from (1) Privatization (state divestment and IPO), (2) Lift up the Foreign ownership limitation and (3) low valuation ratio compared to Asean countries.

Disclosure: The author does not have holdings or positions or derivative instruments in any of the above mentioned ETFs, companies or currencies.