CHAPEL HILL, N.C. (MarketWatch) — Do you remember what you were worried about exactly a year ago?

If you’re like almost every investor I ask, you have no idea.

And that’s one big reason why you most likely haven’t beaten the stock market over the past 12 months. If you were the type of investor who did remember, you’d appreciate how investors’ obsessions change as often as the weather. And with that realization comes the recognition that you won’t beat the market by constantly reacting to news headlines.

To jog your memory: A year ago, almost certainly your obsession was the slowing Chinese economy. Investors were terrified by projections that the growth rate of China’s economy in 2015 would be the slowest in decades. The Chinese market crashed, with the Shanghai market plunging 8.5% on one day alone in late August.

Those concerns led to panic selling in the U.S. equity market. In one five-minute window during late August 2015, the Dow Industrials were down by more than 1,100 points.

From today’s perspective, of course, we can smile knowingly at those “silly” obsessions. Of course the world didn’t come to an end. In fact, late August 2015 was a great buying opportunity.

And, yet, investors never learn. By my count since that China swoon, the U.S. stock market has suffered at least three additional attacks of doom and gloom:

• The January-February 2016 stock market correction.

• Concerns about first-quarter GDP and a disappointing earnings season.

• The unexpected outcome of the U.K. Brexit referendum.

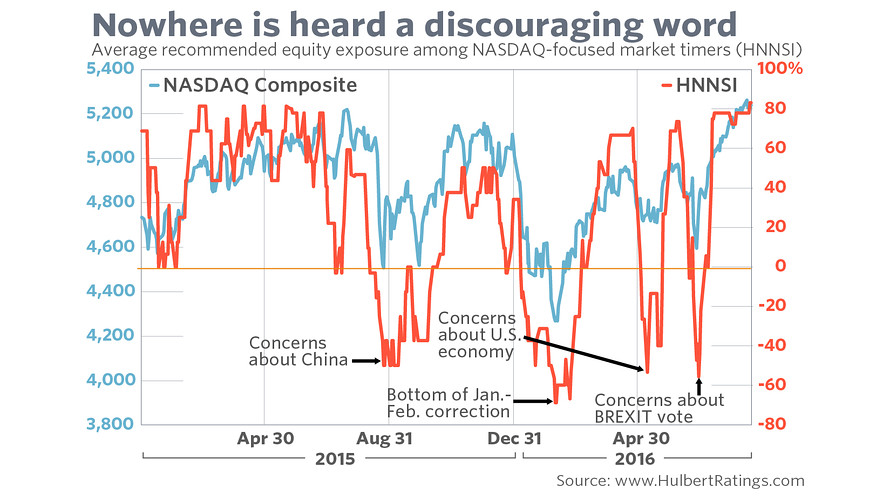

The accompanying chart shows all four of the past year’s spasms of fear. It plots the average recommended stock market exposure level among a subset of Nasdaq-focused stock market timers (as measured by the Hulbert NASDAQ Newsletter Sentiment Index, or HNNSI). Notice that in all four instances, this average recommended exposure level dropped to below minus 40%, which meant that on each occasion the average Nasdaq-oriented timer was advising clients to allocate more than 40% of their equity portfolios to going short, or betting on a decline.

Not coincidentally, according to contrarian analysis, all four occasions were great buying opportunities. And it is not just Monday-morning quarterbacking to point this out. Consider these contrarian-oriented columns that came shortly after those gloom-and-doom-induced swoons:

• Aug. 28, 2015: “Stocks climbing strongest wall of worry in five years.”

• March 4, 2016: “Here’s why you can expect more upside for U.S. stocks.”

• May 6, 2016: “Big drop in bullishness for U.S. stocks could actually be a good sign.”

• July 1, 2016: “Stock-market timers turn shockingly bearish — and that’s good for the bulls.”

Unfortunately for the bulls, the sentiment pendulum today is at the opposite end of the spectrum from where it was on each of those prior occasions. The HNNSI today stands at above 80%.

To be sure, the HNNSI has been at lofty levels for several weeks now, and the stock market has held its own. Nevertheless, if history is any guide, we are unlikely to see as explosive a rally in coming weeks as we did following each of those past four occasions in which fear dominated investors’ mood.

If the time to buy is when there is blood running in the streets, the time to sell is when there’s dancing. And right now there is a whole lot of dancing.

By

MARKHULBERT