Rising Inflation And How Can We "Vaccinate" it

Published on June 16, 2021

Long Tran

Head of Research at BIDV Securities Company

Inflation is on the radar of the central banks around the world again, after a half-year stay as low as negative in many countries. Annual inflation in the EU accelerated to 2% in May 2021 from 1.6% in April. In the US consumer prices rose 5% from last May, marking the biggest increase since September 2008.US inflation is nowhere near their target said by Fed Chairman Powell "We do not seek inflation that substantially exceeds 2 percent, nor do we seek inflation above 2 percent for a prolonged period.” Two of the biggest economic powers see inflation close to or tend to pass their long-term target at around 2%.

Well, central banks are focused on controlling inflation, widely considered to be one of the most important macroeconomic indicators. The right inflation spurs (thúc đẩy) the economy by making consumers buy things. But high inflation hurts businesses and threatens to destroy consumers, especially during the healing time after one and a half years of Covid-19 suffering. Since inflation is rising everywhere, the question here is why inflation is so high and how can we vaccinate it?

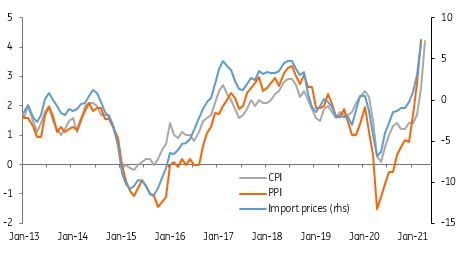

Graph 01: USA's CPI, PPI and import price inflation (YoY%)

The first question we might ask is as follows: Why is inflation so high? In my opinion, the rising inflation is caused by (1) disrupting supply chains (2) Base effects — prices fell significantly last spring and (3) easy monetary policies.

(1) Disrupting supply chains. After 1 year of disembarking because of Covid, everywhere in the world the supply chain is broken and interrupted. Data show us that used car prices, lumber prices, and food prices increased. For example, lumber prices go up because people stay at home and have more time to upgrade their houses. Historic lumber shortage was spurred by a perfect storm of factors set off during the pandemic. Furthermore, Asia consumers scream for more lumber but container shortage leading to more supply chain headaches (and push the lumber price up even further). The same thing happens with mask prices, VGA card prices, oxygen bottle prices, and even used car prices.

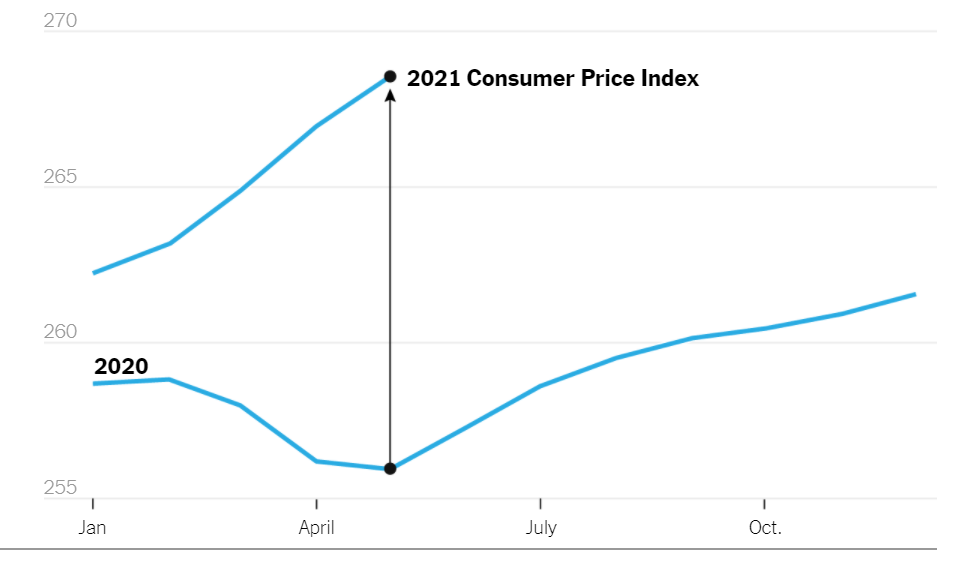

Graph 02: Base effects — prices fell significantly last spring

Notes: C.P.I. of 100 is equal to prices in 1984. Sources: Bureau of Labor Statistics By Ella Koeze

(2) Base effects — prices fell significantly last spring. People say that goods and services' supply and consumption were at their worst in the second quarter of 2020, when China, Europe, and the US was hit by Covid. You remember that the price of crude oil went negative for the first time one year ago. Then, one year later, the price level of commodities jumped the most compared to the bottom of the second quarter of 2020, due to base effects and the fact that demand is recovering faster than supply.

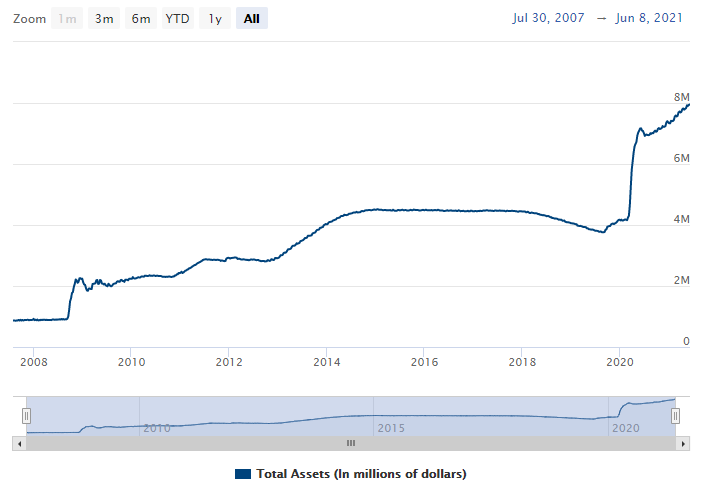

Graph 03: Total Asset of the Federal reserve June 2021

Source: FED

(3) Easy monetary policies. When the recession returned, almost at the same time, the central banks around the globe expressed their concern. They simultaneously eased monetary policy by purchasing long-dated government bonds (in the US), lowering reserve requirements (in China), or reducing operating interest rates. In short, in every country, the government used monetary easing together with easy fiscal policies to prevent recession...

Generally, some amount of inflation is good when it combats the effects of deflation. When consumers expect prices to rise, they spend now, boosting economic growth. When inflation is too high of course, it is not good for the economy or consumers.

The second question is as follows: How can we “vaccinate” inflation? In short, we need every country to be Covid-19 “vaccinated”.

Firstly, the seasonal effect of roaring commodities prices happens naturally and will be here for some time, at least until this second quarter of 2021 ends. Secondly, the easing monetary policies, I believe, will be here much longer, at least until 2022. Even when Fed Chairman Powell said that FED “won’t allow ‘substantial’ overshoot of inflation target”, I think that he rather see inflation rise other than fall.

How's it about disrupting the supply chain? We are living in a globalized and interdependent world where no country can live without demand and supply from others. Take a closer look at your house and all the goods and services that you are consuming. Although you may be buying lumber from local sawmills, you drive cars “made in the EU”, and you eat food “made in Asia”, wear clothes ”made in Africa”, use phones “made in China”. Your phone again, not just made solely in China but has parts from every corner of the world.

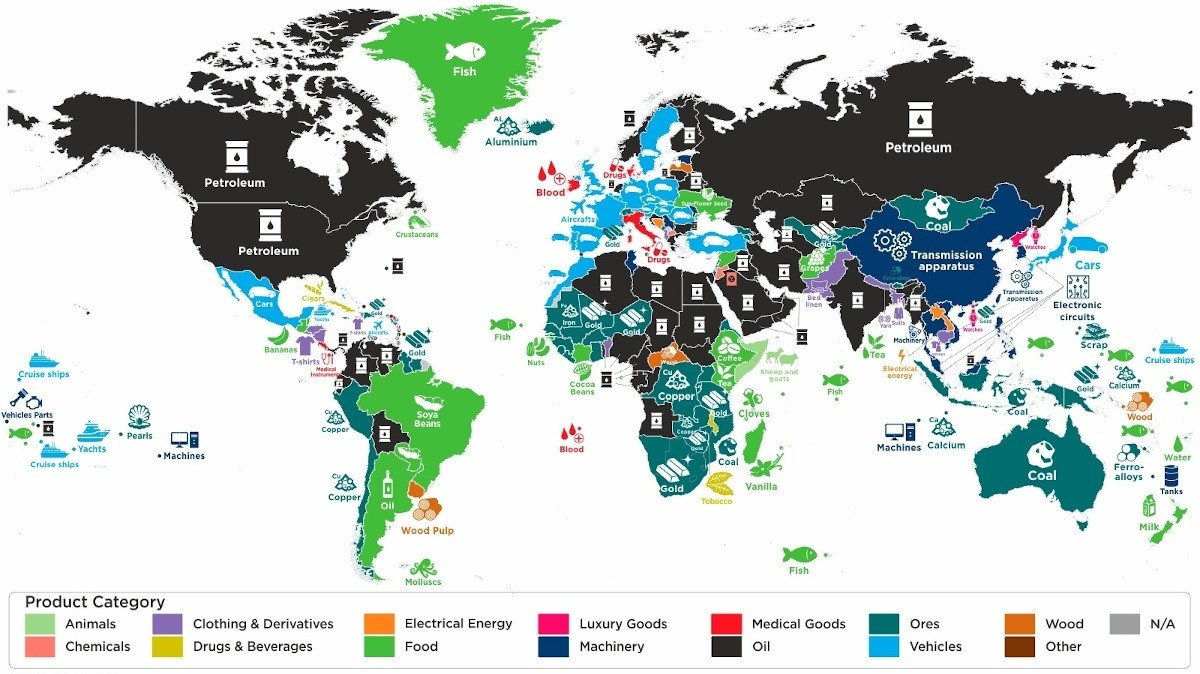

Graph 04: The world top export and import 2018

Source: How much

People always say that advanced countries export automobiles, machinery, high-tech products... while developing countries are the main exporter of raw material, food, electronics, fuels, chemicals, clothes, home wares... We are so interdependent that if we want the price level to get back to normal, the economy of not just developing countries but also developing countries should be back to normal. The world that we lived in need to be vaccinated for the supply chain to be healed.

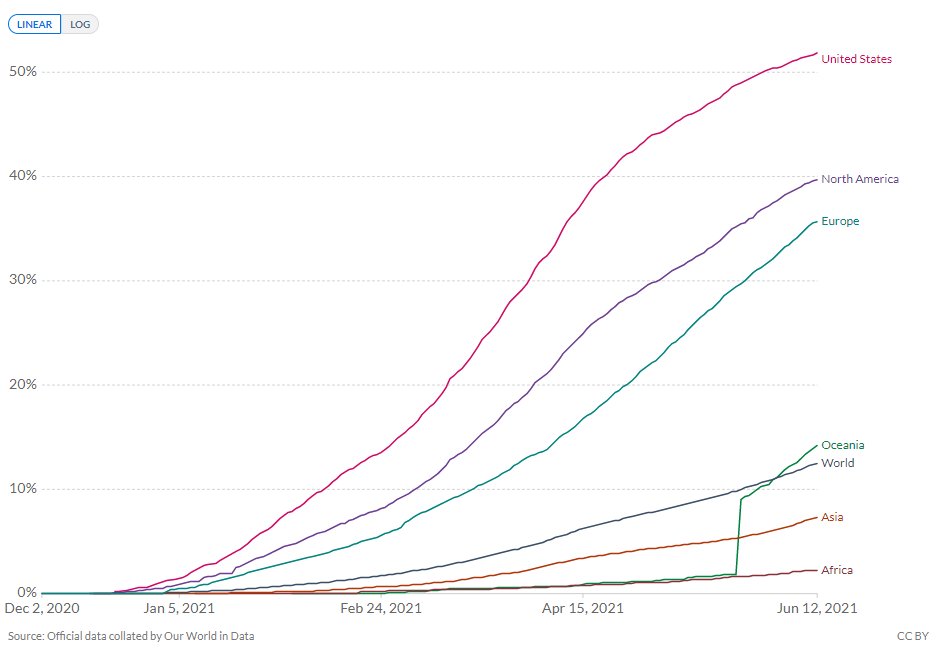

Graph 05: The world vaccination rates by continents

Source: The New York Times - Breaking News, US News, World News and Videos

Now G7 countries have most of their adult population injected with Covid Vaccine. They even have much more vaccine doses than needed while the emerging countries don't have nearly enough. Like in the U.S., there are more than 27 million unused Moderna doses and 35 million doses from Pfizer Inc. and BioNTech SE, according to data compiled by the Centers for Disease Control and Prevention. Moreover, tens of millions of unused Covid vaccine doses are reportedly piling up in Japan and the EU. Vaccinated people start going out and spending when their fellow humans in developing countries still suffer, stay at home, and factories are closed. According to ABC News, the world’s poorest countries are still waiting on vaccines to protect their health care workers and the elderly. Only 0.3% of the vaccine supply is going to low-income countries.

The world economy is running on one engine now. No wonder, the supply chain is disrupted and the price of many goods and services are rising, hurting us all. Lately, US President Biden plans to share 80 million unused vaccine doses (75% of unused COVID-19 vaccines) with the rest of the world. The developed countries should follow the USA and share up doses of its unused vaccines with other countries, and we might all get past this rising inflation together.