Ngày chốt quyền 5/6/23, ngày chi trả 26/6/23.

Như vậy, CSV đã chia cổ tức 2022 tổng cộng 2000 đồng/cp, còn 1500 đồng nữa sẽ chia đến hết năm 2023. Tổng cổ tức trên mỗi cổ phiếu đạt 3,500 đồng/năm, suất sinh lãi cổ tức 11.5%, rất cao so với tiền gửi ngân hàng.

Trong năm 2022, CSV ghi nhận 2104 tỷ doanh thu, +33%; 354 tỷ lợi nhuận sau thuế thuộc về cổ đông công ty mẹ, +69%.

Công ty đặt kế hoạch 2023 với 1957 tỷ doanh thu; 216 tỷ lợi nhuận sau thuế, tương đương EPS cuối năm đạt 4,900 đồng/cp, PEF 6 lần.

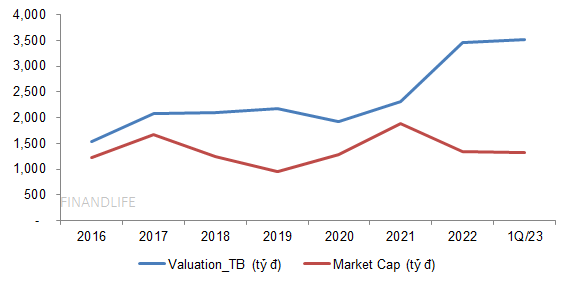

CSV đang được sở hữu 65% bởi nhà nước. Một doanh nghiệp vững mạnh, bị định giá quá thấp so với giá trị thật. Giao dịch cổ phiếu hàng ngày với thanh khoản kém, dễ dàng neo giá thấp giả tạo.

Nếu nhà nước thoái vốn, đây là mồi ngon cho nhà đầu tư nước ngoài, đặc biệt là người Hàn Quốc, người Thái Lan đang rất năng động tìm kiếm các doanh nghiệp trong ngành cơ bản.

Nếu bỏ ra 1,330 tỷ đồng để mua trọn công ty, nhà đầu tư sẽ chỉ mất 3 năm thu hồi vốn. Từ năm thứ 4 trở đi, đó là phần lời.

Nếu là nhà đầu tư tài chính thuần túy (người mua 1 ít cổ phiếu và hưởng thành quả nhờ cổ tức), với mức giá cổ phiếu hiện tại, nhà đầu tư sẽ thu về cổ tức ổn định mỗi năm >10% tính trên vốn đầu tư.

Nếu nhà đầu tư biết cách tạo áp lực trong Đại Hội Cổ Đông, mức sinh lãi cổ tức có thể lên đến 18%/năm tính trên vốn đầu tư. Hiện công ty chỉ dùng 50% lợi nhuận để chi trả cổ tức, chi trả 8-10% lợi nhuận để khen thưởng phúc lợi. Nếu cấu trúc theo hướng nâng lương cho người lao động, và giảm trích quỹ khen thưởng phúc lợi xuống (quỹ khen thưởng phúc lợi là một khoản được trích từ lợi nhuận sau thuế, không được hưởng tấm chắn thế, rất bất lợi cho cổ đông). Khi đó, CSV có thể dùng 80% lợi nhuận để trả cổ tức, thì mức sinh lời cổ tức của cổ đông sẽ tăng lên 60-80% so với hiện tại.

Đây là case đầu tư cơ bản hiếm hoi còn sót lại, NOT BAD DEAL

FINANDLIFE