Source: European Central Bank

Less Than Zero

When Interest Rates Go Negative

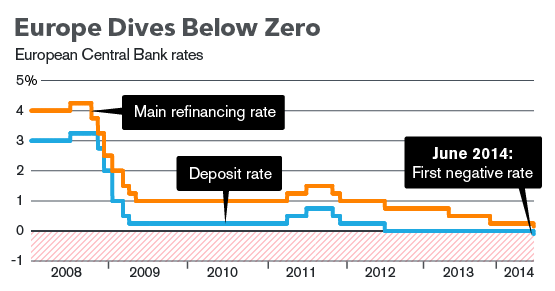

Imagine a bank that pays negative interest. Depositors are actually charged to keep their money in an account. Crazy as it sounds, the European Central Bank has cut a key interest rate below zero, the first major central bank to venture into negative territory. It’s one way to try to reinvigorate (/in·vig·o·rate/ if something invigorates you, it makes you feel healthier, stronger and have more energy)an economy with other options exhausted. It’s an un’orthodox (/un·or·tho·dox/ unorthodox opinions or methods are different from what is usual or accepted by most people) choice that the U.S. Federal Reserve and other peers have so far rejected.

Cảm giác khùng điên khi Ngân hàng Trung ương Châu Âu cắt giảm lãi suất chủ chốt xuống mức dưới 0. Đây là động thái ngược đời nhằm giúp nền kinh tế khỏe mạnh hơn.

ECB officials say more stimulus is needed to prevent a slide into deflation, or a spiral (a line in the form of a curve that winds around a central point, moving further away from the centre all the time) of falling prices that could de’rail (làm chệch hướng)the recovery. The bank cut its deposit rate to minus 0.1 percent from zero and reduced its benchmark interest rate to a record-low 0.15 percent. A negative deposit rate helps the economy by pushing the euro lower. There’s also sluggish demand for loans in the euro zone, where unemployment is stuck near its highest level since the currency bloc was formed in 1999. The bank’s president, Mario Draghi, has been floating the idea of charging lenders to park their excess reserves at the ECB for almost two years. Cutting the deposit rate below zero effectively punishes banks that have extra cash but are reluctant to extend credit to weaker lenders. The ECB has particular reason to use negative interest rates. The Fed and the Bank of Japan have turned to large-scale asset purchases, known as quantitative easing, that create new money to fuel the recovery. European Union rules make it politically difficult for the ECB to buy large volumes of government bonds, though it is offering more liquidity to banks and will start work on plans to purchase asset-backed securities.

Việc làm này nhằm giúp nền kinh tế không rơi vào trạng thái giảm phát, tình trạng có thể làm chệch hướng phục hồi kinh tế. Lãi suất tiền gửi đã về mức âm 0.1% và lãi suất tham chiếu về mức thấp kỷ lục (0.15%). Có những lý do đặc biệt để thực thi chính sách này. Việc FED và Ngân hàng Nhật Bản liên tục mua vào tải sản với khối lượng lớn, chính sách được biết đến như là QE, đã giúp tạo tiền mới để tài trợ sự phục hồi kinh tế. Trong khi đó, Khối Châu Âu lại có những quy định khó làm việc đó, do vậy ngân hàng ECB chỉ còn cách tạo thanh khoản cao cho các ngân hàng.

The Background

With interest rates at all of the world’s major central banks effectively at bottom, officials are looking again at what’s sometimes called the sacred “lower bound” of their main monetary policy tool. Negative deposit rates have been used by a handful of smaller central banks in recent years, including Sweden’s, which conducted a 14-month experiment in 2009-2010. Denmark moved below zero in July 2012 — though the cut was aimed more at protecting its currency than stimulating growth — and ended the policy in April. There is no guarantee that negative rates will be able to revive (hồi sinh)an entire economy or work in one as large as the euro area. During the height of Europe’s sovereign debt crisis almost two years ago, Draghi pledged to do “whatever it takes” to save the area’s common currency, signaling the ECB’s willingness to experiment with monetary policy.

Đây chỉ là giải pháp ngắn hạn, và không lấy gì làm đảm bảo sẽ giúp hồi sinh toàn bộ nền kinh tế. Trong lịch sử, đã có một số quốc gia từng sử dụng chính sách này như Thụy Điển năm 2009-2010; Đan Mạnh năm 2012

The Argument

In theory, an interest rate below zero should lower all market rates, thus also reducing borrowing costs for companies and households. In practice, though, there’s a risk that the policy might do more harm than good. Janet Yellen, the Fed chair, said at her confirmation hearing Nov. 14 that the closer the deposit rate is to zero, the bigger the risk of disruption (/dis·rup·tion/ a situation in which something is prevented from continuing in its usual way) to the money markets that help fund banks. (The Fed pays 0.25 percent on excess reserves.) In Denmark, commercial banks didn’t pass on the negative rates to depositors for fear of losing customers. When banks absorb the costs themselves, it squeezes the profit margin between their lending and deposit rates, and might make them even less willing to lend.

Về lý thuyết, lãi suất bé hơn không có thể giúp giảm chi phí đi vay cho doanh nghiệp và cho người mua nhà. Trong thực tế, có một rủi ro mà chính sách có thể gây hại hơn là tốt, đó là có thể dòng tiền dành cho ngân hàng sẽ bị gián đoạn.

Nguồn: finandlife dịch|Jana Randow, Bloomberg