by finandlife26/11/2019 10:40Key Summary

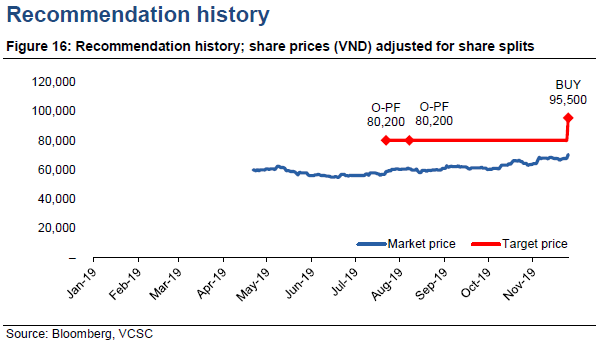

- We upgrade PTB from OUTPERFORM to BUY as we raise our target price by 19% due to a rollover of our valuation to YE2020 and increased 2021F-2022F NPAT-MI; this is despite trimming our 2020F NPAT-MI forecast by 3%, mainly due to higher interest and SG&A expenses.

- We raise our 2021F-2022F NPAT-MI by 11% on average as (1) we add the new quartz business to our forecasts and (2) selling prices of PTB’s residential project exceed our projections by ~25%.

- We expect quartz will start generating revenue in mid-2020 and contribute 8% to gross profit in 2022F, partly bolstering our forecast of a 2020F-2022F CAGR of 17% for the stone segment.

- In addition to a rising contribution from quartz business, our forecast of accelerating EPS growth in 2020F-2021F is premised on (1) the fact that 2019 EPS is diluted by a 5:1 rights issue carried out in Q2 2018 and (2) a projected contribution from the residential real estate project in 2021.

- PTB looks attractive with a 2020F PER of 6.9x vs a 5Y average peer TTM PER of 10.7x. Still, we maintain our target price at a 20% discount to our SOTP valuation given PTB’s conglomerate structure, new foray into real estate, weak free cash flow and limited information disclosure.

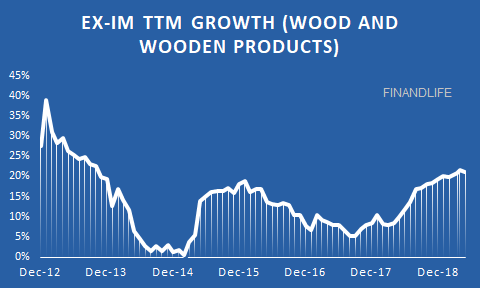

- Potential downside risks to our positive view: slowdown in domestic construction activity; new tariffs on Vietnamese wooden furniture; sluggish real estate and quartz execution.

VCSC Research

d0f6d3e3-c91d-4382-816e-a9edff790ef6|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PTB

Stocks

by finandlife31/10/2019 08:2735677876-c0af-4313-bf7c-ec033675dc5c|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PTB

Stocks

by finandlife18/10/2019 08:55

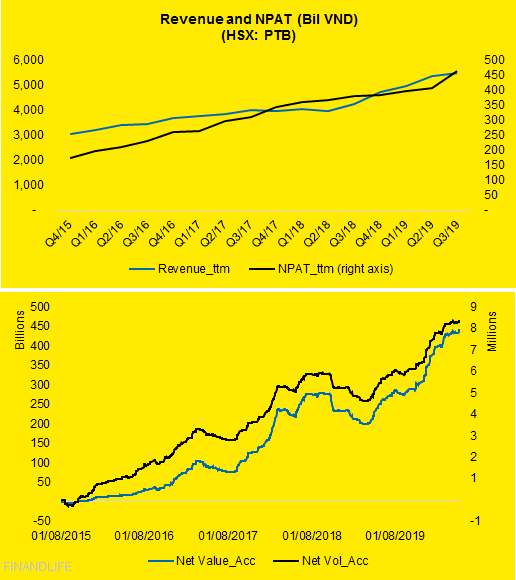

Revenue and Net profit after tax keep going up. Foreigners keep buying more. Don’t sell any stock up to 2021. If holding at this price, your return is 35% annually in the next three years.

Enjoy it.

FINANDLIFE

8947a1a5-2e59-487b-a904-b6d25f12ccd9|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PTB

Stocks

by finandlife05/07/2019 10:43

Phu Tai Joint Stock Company (HSX: PTB) is the top 50 companies which had the best performance in Vietnam many years in a row. They set the target of leading Vietnam's wood industry, except for FDI enterprises.

Chairman Le Vy's business philosophy "invest synchronously from input to output, build factories even in crisis period helps to take advantage in good economic context.”

FINANDLIFE

de2bbfde-903e-47b7-8bcd-f0411bc2874b|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PTB, ngành gỗ

Stocks

by finandlife13/04/2019 14:09effb9f7f-bdd6-42fb-b92a-4b28e2751ded|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: PTB

Stocks