by finandlife10/04/2023 13:23 by finandlife26/03/2022 10:47

"Three things ruin people: drugs, liquor, and leverage."

Munger

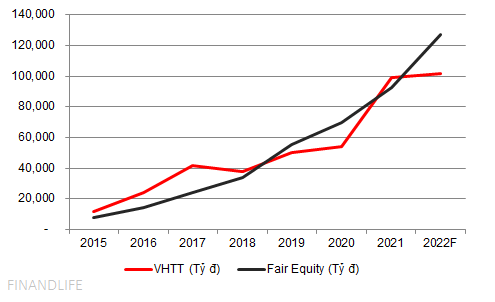

VCSC Research dự báo lợi nhuận sau thuế thuộc về cổ đông công ty mẹ tăng trưởng 39% trong năm 2022.

Nếu hoàn thành dự phóng này, giá trị hợp lý vốn chủ sở hữu của Nhà bán lẻ hàng đầu Việt Nam ước đạt 127 ngàn tỷ đồng, upside 25% so với thị giá hiện tại sau khi đã điều chỉnh ESOP.

Tỷ suất sinh lãi hấp dẫn cho doanh nghiệp hàng đầu, rủi ro thấp.

FINANDLIFE

0b41b4a5-3d0c-4715-b7a9-9576f7b9cb9c|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: MWG

Stocks

by finandlife25/03/2020 20:49

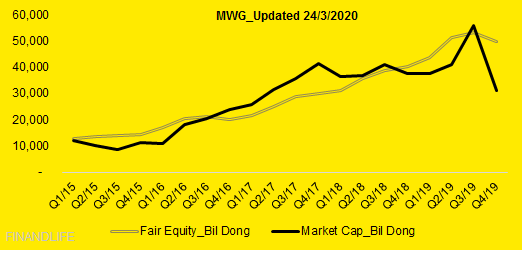

MWG is known as the super stock in Vietnam. Most of fund has to hold MWG in their portfolio if they don’t want to underperform. But everything collapses very quickly. Market capital was 50 thousand Vietnam Dong, equivalent 2 billion US Dollar at the end of 2019, but now its market cap is 31 thousand Vietnam Dong, equivalent 1.3 billion US Dollar. The price shrink 40% in 3 months. That’s really crazy.

We have followed the MWG's fair equity and market cap to determine the GAP day by day. This sharp decline creates the biggest GAP between market cap and fair equity in the history. It never be easy to predict the future, no one can be sure the earnings of MWG in the next three year, especially in this Covid 19 epidemic situation. But the huge drop of price in the very short time may trigger new players.

BOM is going to buy 2 million shares. That is necessary, and we expect to see they can keep the fast growth in the coming years.

FINANDLIFE

3929bae0-c946-4585-a74f-87aeed24caee|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: MWG

Stocks

by finandlife21/09/2019 12:33

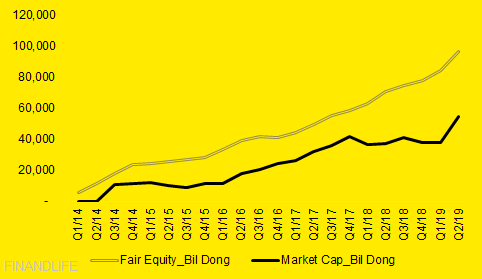

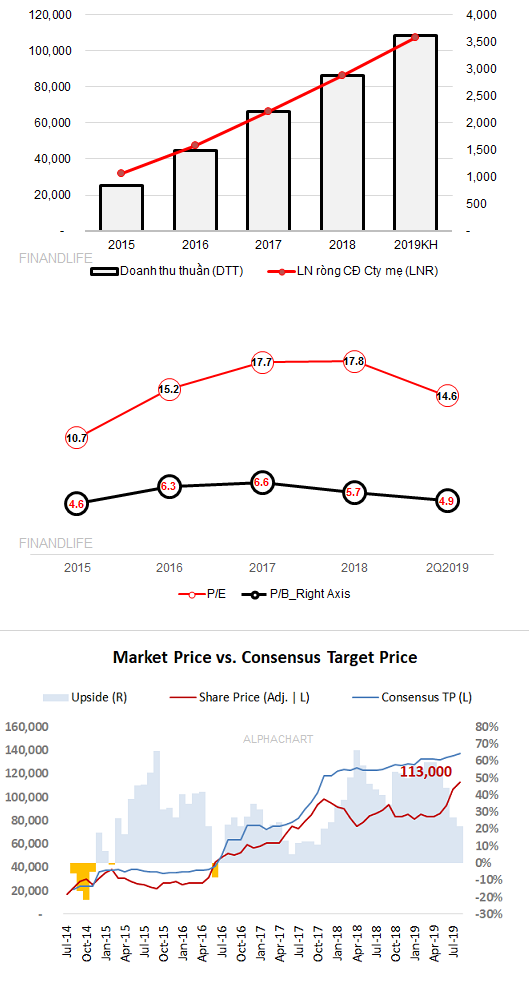

Giá mục tiêu gần nhất 215k đồng/cp.

7d896165-1afc-420c-a162-fd0dd0fc5b96|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: MWG

Stocks

by finandlife10/08/2019 09:13

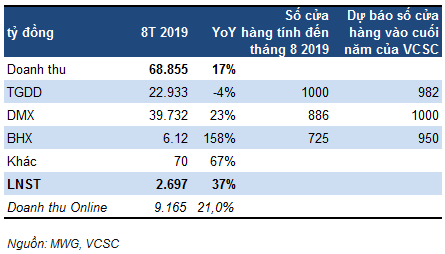

"Chúng tôi đã tham dự buổi tham quan các cửa hàng và gặp gỡ NĐT của CTCP Đầu tư Thế giới Di động (MWG) trong 2 ngày qua. Nhìn chung, các điểm ghi nhận chính củng cố cho quan điểm tích cực của chúng tôi về MWG. Chúng tôi cho rằng có khả năng điều chỉnh tăng dự báo hiện tại, dù cần đánh giá chi tiết hơn, đặc biệt là liên quan đến tốc độ mở các cửa hàng DMX (chuỗi bán lẻ điện máy) và BHX (chuỗi siêu thị mini), doanh số/cửa hàng của BHX cũng như đóng góp doanh thu từ các mảng mới như đồng hồ và mắt kính."

ĐẶNG VĂN PHÁP, VCSC

d605a2d0-fb0c-4a5f-b97a-51c6350a6106|0|.0|27604f05-86ad-47ef-9e05-950bb762570c

Tags: MWG

Stocks