Two reports released by the World Bank provide new insights on Vietnam’s freight logistics sector, including inland and coastal waterways, highlighting that it can be a new driver of growth for Vietnam.

Báo cáo của World Bank về ngành hậu cần vận tải hàng hóa bao gồm cả nội địa và ven bờ, chỉ rõ “đây có thể là ngành dẫn dắt tăng trưởng cho Việt Nam”.

According to Victoria Kwakwa, the World Bank’s country director for Vietnam, “many of the country’s past sources of economic growth—such as a shift in economic activity towards higher-productivity manufacturing and a rapidly growing labor force—are quickly depleting and need to be replaced with new sources of productivity growth. Moreover, Vietnam’s exposure to the risks caused by climate change—such as sea level rise and increasingly unpredictable severe-weather events—make it imperative for Vietnam to find less carbon-intense development trajectories. We believe that more efficient transport and freight logistics can play a critical role in meeting both these challenges.”

The report “Efficient Logistics: A Key to Vietnam’s Competitiveness” finds that logistics operations in Vietnam are costly relative to key regional peers like China, Malaysia, and Thailand. It is estimated that Vietnam’s shippers spend approximately US$100 million annually in extra inventory carrying costs incurred due to import-export clearance delays; and this amount is projected to reach US$180 million by 2020. Various factors contribute to the high cost, such as cumbersome and inconsistently applied government regulations and major supply-demand imbalances in infrastructure provision, just to name a few.

Dự báo cho thấy những chủ hàng của Việt Nam tiêu tốn gần 100 triệu USD hàng năm cho chi phí giải phóng hàng tồn xuất nhập khẩu. Và con số này có thể tăng đến 180 triệu USD cho đến năm 2020.

However, these drawbacks can be reverted if the country adopts a number of actions, such as minimizing paper-based processes in the customs and technical clearance of imports and exports, and creating “multimodal logistics corridors” where containerized flows on trucks or barges can move on adequate infrastructure and with minimal regulatory delays. Opening the logistics market and promoting a more sustainable supply-demand balance in the trucking industry can also help.

The report argues that better performing logistics can provide international and domestic investors with an environment where they can source products for export at a lower total landed cost than what they incur in other countries. A stronger logistics sector is also consistent with Vietnam’s long-term vision of spurring export-led growth.

Báo cáo cũng cho rằng “dịch vụ logistics tốt hơn có thể cung cấp môi trường đầu tư tốt hơncho cả những nhà đầu tư nước ngoài lẫn trong nước”, vì khi đó, tổng chi phí lưu kho, xuất nhập hàng sẽ rẻ hơn so với những quốc gia khác.

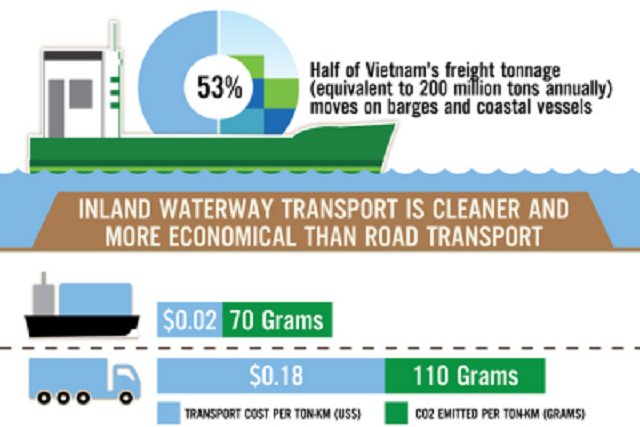

“Facilitating Trade through Competitive, Low-Carbon Transport”, a report on Vietnam’s inland and coastal waterways, concludes that further investment in Vietnam’s inland waterway transport and coastal shipping sector can bring about significant economic returns, as the sector offers attractive economies of ship size. Investment in waterborne transport go well beyond the need to match demand and supply, as larger barges not only result in lower unit transport costs but also lower emissions of pollutants and greenhouse gases — a major benefit to Vietnam, given the country’s exposure to the risks caused by climate change.

It provides a number of recommendations to realize the potential benefits of waterborne transport, including capacity expansion for the corridor linking Vinh Long and Ho Chi Minh City — including the Cho Gao Canal, the network’s most pressing bottleneck at present. Investments in the Northern corridor from Quang Ninh to Viet Tri also appear to be economically viable, as well as a dedicated coastal shipping terminal at Haiphong port. The report also suggests the establishment of a Waterway Maintenance Fund to better pay for maintenance of the core sections of the national inland waterway network.

“The research we have conducted over the past 2-3 years, including numerous conversations with freight logistics stakeholders in Vietnam, reveals that unpredictability in supply chains is the main driver of logistics costs for Vietnam. We hope that the recommendations made in the reports can contribute to the shaping of policies that can make logistics operations more competitive, which would generate employment opportunities, spur economic growth, and improve import-export performance,” says Luis Blancas, the lead author for the two reports.

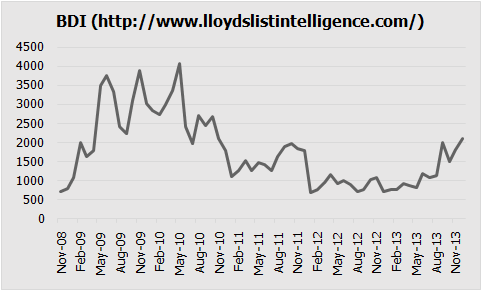

Trong thời gian gần đây, chỉ số BDI, chỉ số đại diện cho giá cả vận tải hàng khô cho thấy một sự phục hồi rất đáng kể. Điều này cho phép nhà đầu tư nghĩ đến ngành vận tải như một cơ hội đầu tư vào, và qua đó cùng chờ đợi một chu kỳ làm ăn mới của lĩnh vực vốn dĩ rất hấp dẫn này.

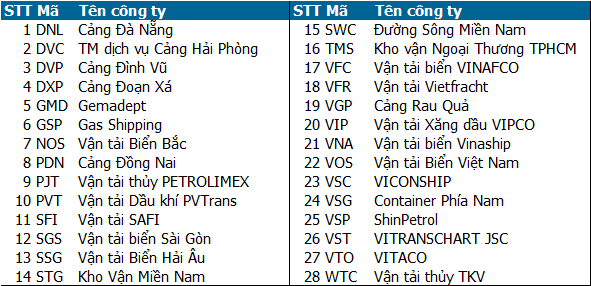

Một số doanh nghiệp niêm yết đáng quan tâm trong lĩnh vực này gồm:

Nguồn: finandlife|maritime-executive.com